Convertible Life Insurance Policy offers a unique blend of flexibility and affordability. Imagine a life insurance policy that starts as a term policy, providing coverage for a specific period, but can later be transformed into a permanent policy, offering lifelong protection.

This adaptability allows you to adjust your coverage as your life changes, ensuring you always have the right protection at the right time.

Convertible life insurance is particularly appealing for individuals who are unsure about their long-term insurance needs. Perhaps you’re starting a family, building a business, or simply want to secure your loved ones’ financial future. With convertible life insurance, you can start with a term policy, which is typically more affordable, and then convert it to a permanent policy when you’re ready.

This approach allows you to enjoy the benefits of both types of coverage without being locked into a single plan.

Introduction to Convertible Life Insurance

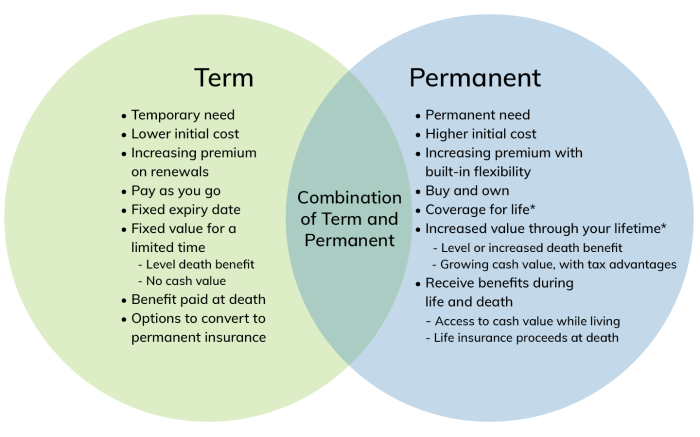

Convertible life insurance is a type of term life insurance policy that offers the flexibility to convert to a permanent life insurance policy at a later date. This unique feature allows policyholders to secure permanent coverage while enjoying the lower premiums of term life insurance initially.Convertible life insurance policies are designed to provide temporary coverage for a specific period, typically 10, 20, or 30 years.

During this term, the policyholder pays a lower premium compared to permanent life insurance policies. However, the key advantage lies in the conversion option. At any point during the term, the policyholder can choose to convert the term life insurance policy to a permanent life insurance policy, such as whole life or universal life insurance, without undergoing a medical examination.

Benefits of Convertible Life Insurance

Convertible life insurance offers several benefits, making it a suitable option for individuals seeking flexibility and long-term coverage:* Flexibility:The ability to convert to a permanent life insurance policy provides flexibility to adapt to changing life circumstances.

Lower Premiums

During the term, policyholders enjoy lower premiums compared to permanent life insurance policies.

Guaranteed Conversion

The conversion option is guaranteed, meaning the policyholder can convert to a permanent policy without undergoing a medical examination.

Peace of Mind

Convertible life insurance provides peace of mind, knowing that the option to convert to permanent coverage is available when needed.

Situations Where Convertible Life Insurance Might Be Beneficial

Convertible life insurance can be a valuable option in various situations:* Young Families:Young families with growing financial responsibilities can benefit from the lower premiums of term life insurance while having the option to convert to permanent coverage later as their financial needs evolve.

Individuals with Uncertain Future

Individuals facing uncertain career paths or financial situations may find convertible life insurance attractive as it provides the flexibility to adjust their coverage later.

Individuals with Health Concerns

Individuals with pre-existing health conditions may find it difficult to qualify for permanent life insurance. Convertible life insurance allows them to secure coverage now and convert to a permanent policy later when their health may improve.

Conversion Process

The conversion process is generally straightforward. Policyholders can typically convert their term life insurance policy to a permanent policy by:* Contacting the Insurer:The policyholder needs to contact the insurance company and request the conversion.

Paying a Higher Premium

The premium for the permanent life insurance policy will be higher than the term life insurance premium.

Choosing a Permanent Policy

The policyholder can choose the type of permanent life insurance policy that best suits their needs, such as whole life or universal life insurance.

Factors to Consider, Convertible Life Insurance Policy

When considering convertible life insurance, several factors are important:* Conversion Age Limits:Most policies have age limits for conversion, typically around age 65.

Conversion Premiums

The premium for the converted permanent life insurance policy will be based on the policyholder’s age and health at the time of conversion.

Policy Terms

It’s crucial to review the policy terms and conditions carefully to understand the conversion process and any limitations.

Conclusion

Convertible life insurance provides a flexible and affordable solution for individuals seeking temporary coverage with the option to convert to permanent life insurance later. By carefully considering the benefits, situations where it might be beneficial, and factors to consider, individuals can make an informed decision about whether convertible life insurance is the right choice for their needs.

Advantages of Convertible Life Insurance: Convertible Life Insurance Policy

Convertible life insurance offers several advantages that make it an attractive option for individuals seeking flexibility and adaptability in their financial planning. Its unique structure provides the potential for both short-term and long-term benefits, making it a versatile tool for various life stages and situations.

Flexibility and Options

Convertible life insurance policies provide a level of flexibility that traditional term life insurance policies lack. The ability to convert the policy to a permanent life insurance policy grants the policyholder the power to adapt to changing circumstances and needs without having to start a new policy or undergo a new underwriting process.

Convertible life insurance offers a valuable safety net for individuals who may not know their future insurance needs with certainty.

Addressing Changing Life Circumstances and Needs

As individuals progress through different stages of life, their financial needs and priorities often evolve. Convertible life insurance can accommodate these changes by allowing policyholders to convert their term policy to a permanent policy when their circumstances warrant it.

- For example, a young family with a mortgage and growing children may choose a term life insurance policy to provide coverage during their most vulnerable years. However, as the children grow older and the mortgage is paid off, the need for term life insurance may diminish.

The policyholder can then convert their term policy to a permanent policy, providing lifelong coverage and potentially building cash value.

- Another example is a young professional who may initially prioritize short-term coverage for a relatively low premium. As they advance in their career and their financial obligations increase, they may choose to convert their term policy to a permanent policy to ensure their loved ones are financially protected for the long term.

Locking in Lower Premiums

One of the key advantages of convertible life insurance is the ability to lock in lower premiums during the term period. Since premiums for term life insurance are generally lower than those for permanent life insurance, individuals can take advantage of these lower rates while they are younger and healthier.

When the policyholder decides to convert their term policy to a permanent policy, the premium will be based on their age and health at the time of conversion.

- This means that if the policyholder’s health deteriorates or they become older, they will still be able to convert their policy at a lower premium than they would have received if they had purchased a permanent policy at that time.

- This feature can be particularly beneficial for individuals who are concerned about the potential for rising premiums as they age.

Types of Convertible Life Insurance Policies

Convertible life insurance policies offer the flexibility to switch from a temporary coverage plan to a permanent life insurance policy. This provides a valuable safety net, allowing you to secure lifelong coverage later if needed. The conversion option offers peace of mind, knowing you have the choice to secure permanent coverage even after your initial term expires.

Term to Whole Life Conversion

This type of conversion allows you to switch from a term life insurance policy to a whole life insurance policy. Term life insurance provides temporary coverage for a specific period, while whole life insurance offers lifelong coverage.Term to whole life conversion is a popular option for individuals who want the affordability of term life insurance but also want the option to secure permanent coverage in the future.

The conversion process typically involves paying a higher premium for the whole life policy, reflecting the permanent coverage and cash value accumulation.

Conversion Options

- Guaranteed Conversion:This option guarantees the conversion to a whole life policy, regardless of your health status at the time of conversion. However, you may need to pay a higher premium than if you were in good health.

- Non-Guaranteed Conversion:This option allows you to convert to a whole life policy, but your health status at the time of conversion will be considered. If your health has deteriorated, you may be denied conversion or required to pay a higher premium.

Advantages

- Flexibility:You have the option to secure permanent coverage later if needed.

- Affordability:Term life insurance is generally more affordable than whole life insurance.

Disadvantages

- Higher Premiums:You may need to pay a higher premium for the whole life policy, especially if you convert after your health has deteriorated.

- Limited Conversion Period:Most convertible term life insurance policies have a limited conversion period, typically within the first 10-20 years of the policy.

Term to Universal Life Conversion

This type of conversion allows you to switch from a term life insurance policy to a universal life insurance policy. Universal life insurance offers flexible premiums and death benefits, allowing you to adjust your coverage and investment options as your needs change.Term to universal life conversion is a good option for individuals who want the flexibility and control of a universal life policy.

However, it’s important to note that universal life policies are more complex than whole life policies and require careful consideration of your financial goals.

Conversion Options

- Guaranteed Conversion:Similar to term to whole life conversion, this option guarantees the conversion to a universal life policy, regardless of your health status at the time of conversion. You may need to pay a higher premium than if you were in good health.

- Non-Guaranteed Conversion:This option allows you to convert to a universal life policy, but your health status at the time of conversion will be considered. If your health has deteriorated, you may be denied conversion or required to pay a higher premium.

Advantages

- Flexibility:You have the option to adjust your coverage and investment options as your needs change.

- Affordability:Term life insurance is generally more affordable than universal life insurance.

Disadvantages

- Complexity:Universal life insurance policies are more complex than whole life policies and require careful consideration of your financial goals.

- Potential for Higher Premiums:Universal life insurance premiums can fluctuate based on investment performance and interest rates.

Factors to Consider When Choosing Convertible Life Insurance

Convertible life insurance offers flexibility, but choosing the right policy requires careful consideration. Evaluating your current and future financial needs, your age, health, and lifestyle will help you determine if this type of insurance is suitable for you.

Impact of Age, Health, and Lifestyle

Your age, health, and lifestyle play a significant role in determining the suitability of convertible life insurance. As you age, your health may change, and your life insurance needs may evolve. If you’re young and healthy, you may benefit from a convertible policy, as it allows you to lock in a lower premium and convert to a permanent policy later when your health may have changed or your insurance needs have increased.

However, if you have pre-existing health conditions or are in a high-risk profession, your conversion options may be limited, and the premiums for a permanent policy may be higher.

Conversion Process and Considerations

Converting a term life insurance policy to a permanent life insurance policy is a significant decision that involves specific steps and considerations. This process allows you to lock in a guaranteed death benefit and build cash value, providing long-term financial security.

Steps Involved in Conversion

The conversion process involves several steps, typically initiated by the policyholder.

- Contact Your Insurance Company:The first step is to reach out to your insurance company and express your desire to convert your term life insurance policy. This can usually be done by phone, email, or through their website.

- Provide Required Information:The insurance company will likely request certain information from you, such as your current policy details, health status, and desired coverage amount.

- Complete a Medical Examination:In most cases, you will be required to undergo a medical examination, which includes a physical and potentially some medical tests. This helps the insurance company assess your current health and determine the appropriate premium for your new permanent policy.

- Review and Accept the Conversion Offer:Once the insurance company has reviewed your application and medical information, they will present you with a conversion offer, including the new premium rate and policy terms. You have the opportunity to review the offer carefully and accept or decline it.

A Convertible Life Insurance Policy is like a chameleon, able to change its form! It starts as a term life policy, providing coverage for a specific period, but then can transform into a permanent policy, offering lifelong coverage. This transformation can be particularly useful for those seeking long-term financial security, especially if they have a defined-benefit plan like a pension.

What Is a Defined-Benefit Plan? A defined-benefit plan provides a guaranteed income stream during retirement, making it a good complement to a convertible life insurance policy, which can offer a lump-sum death benefit for your loved ones.

- Pay the Premium:After accepting the conversion offer, you will need to pay the first premium for your new permanent life insurance policy.

Requirements and Timelines

The requirements and timelines for converting a term life insurance policy vary depending on the specific policy and the insurance company.

- Conversion Period:Most term life insurance policies have a conversion period, usually within a certain number of years from the policy’s inception. This is the timeframe during which you can convert your policy to a permanent policy without providing additional health information.

- Health Requirements:If you convert your policy outside of the conversion period, you may need to provide updated health information, which could potentially affect the premium rates.

- Age Limits:Some insurance companies may have age limits for conversion, meaning you may not be able to convert your policy after reaching a certain age.

Factors Affecting Premium Rates

Several factors can influence the premium rates after converting your term life insurance policy to a permanent policy.

- Age:As you get older, your risk of death increases, which can lead to higher premium rates.

- Health:Your health status at the time of conversion can significantly impact your premium rates. If you have developed any health conditions since purchasing your term policy, your premiums may be higher.

- Type of Permanent Policy:Different types of permanent life insurance policies, such as whole life or universal life, have different premium structures and can affect the cost of your policy.

- Coverage Amount:The amount of coverage you choose for your permanent policy will also affect the premium rate. A higher coverage amount generally results in higher premiums.

Real-World Examples and Case Studies

Convertible life insurance is a powerful financial tool, but understanding its practical applications can be challenging. This section delves into real-world examples and case studies to illustrate how individuals have successfully leveraged convertible life insurance to achieve their financial goals.

These examples demonstrate the benefits and challenges associated with conversion, providing valuable insights for those considering this type of insurance.

Successful Utilization of Convertible Life Insurance

These examples showcase how individuals have utilized convertible life insurance to meet their evolving financial needs.

- Sarah, a young professional, purchased a term life insurance policy when she started her career. As she progressed, her income and responsibilities increased, making permanent life insurance more desirable. Sarah converted her term policy to a permanent policy, ensuring long-term coverage and building cash value for future financial goals.

- John, a business owner, initially opted for term life insurance due to budget constraints. As his business grew, he needed permanent life insurance for estate planning and business succession purposes. John converted his term policy to a permanent policy, providing his family and business with long-term financial security.

Case Studies Demonstrating Benefits and Challenges

Case studies offer a deeper understanding of the benefits and challenges associated with converting life insurance.

- Case Study 1: The Retiree– A retired individual, previously covered by a group life insurance policy through their employer, converted their policy to a permanent policy upon retirement. This conversion provided them with lifelong coverage and a guaranteed death benefit, ensuring their family’s financial security in their later years.

However, the conversion process involved a higher premium due to their age and health status. The retiree had to carefully consider their budget and financial resources before making the decision.

- Case Study 2: The Young Family– A young couple with a newborn baby purchased a term life insurance policy to protect their family in case of an unexpected event. As their family grew and their financial responsibilities increased, they converted their term policy to a permanent policy to ensure long-term coverage and build cash value for their children’s education.

The conversion process allowed them to lock in a lower premium rate due to their younger age and good health, providing them with a more affordable option for long-term financial security.

Convertible Life Insurance and Financial Goal Achievement

Real-world examples demonstrate how convertible life insurance can be a valuable tool for achieving financial goals.

- Estate Planning– Convertible life insurance can be used to create a death benefit that can be used to cover estate taxes, funeral expenses, and other financial obligations. This can help ensure that your family is financially secure in the event of your death.

- Business Succession– Convertible life insurance can be used to provide financial support to a business in the event of the death of a key employee or owner. This can help ensure that the business can continue to operate smoothly and that the owner’s family is financially protected.

- Retirement Planning– Convertible life insurance can be used to build cash value that can be accessed during retirement. This can provide a source of income or a lump sum payment to help cover retirement expenses.

- College Funding– Convertible life insurance can be used to build cash value that can be used to fund a child’s education. This can help ensure that your child has the financial resources they need to pursue their educational goals.

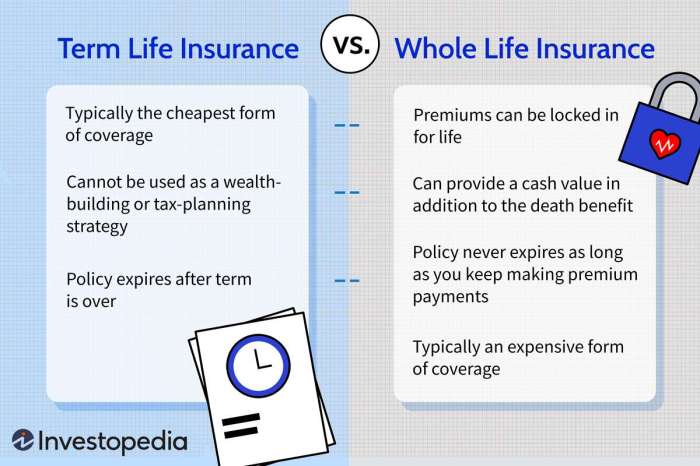

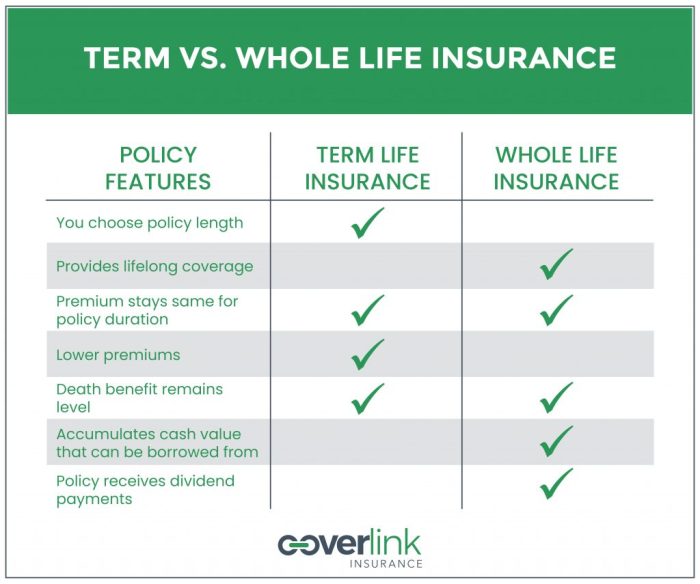

Comparison with Other Life Insurance Options

Convertible life insurance is a versatile option, but it’s essential to understand how it stacks up against other popular life insurance types. This section delves into a comprehensive comparison of convertible life insurance with traditional term and permanent life insurance policies, shedding light on their advantages, disadvantages, and suitability for different life stages and circumstances.

Comparison of Key Features

The table below provides a concise comparison of convertible life insurance with term and permanent life insurance policies, highlighting their key features and characteristics:

| Feature | Convertible Life Insurance | Term Life Insurance | Permanent Life Insurance |

|---|---|---|---|

| Coverage Period | Initially a term policy, convertible to permanent later | Fixed term (e.g., 10, 20, 30 years) | Lifetime coverage |

| Premium Payments | Initially lower than permanent, potentially higher after conversion | Lower premiums than permanent, fixed for the term | Higher premiums than term, paid for life |

| Cash Value | No initial cash value, accrues after conversion | No cash value | Accumulates cash value that can be borrowed against |

| Flexibility | Offers the option to convert to permanent coverage later | Limited flexibility, typically renewed or discontinued at the end of the term | Provides flexibility with cash value and potential investment options |

| Suitability | Ideal for those uncertain about long-term needs, seeking coverage flexibility | Suitable for temporary coverage needs, such as during a mortgage or child-rearing | Best for long-term coverage, estate planning, and wealth accumulation |

Advantages and Disadvantages of Each Option

Understanding the advantages and disadvantages of each life insurance type can help you make an informed decision:

Convertible Life Insurance

Advantages

- Lower Initial Premiums:Convertible life insurance initially offers lower premiums compared to permanent policies, making it more affordable in the early years.

- Flexibility:It provides the option to convert to permanent coverage later, allowing you to adapt to changing needs and circumstances.

- Coverage Security:If your circumstances change and you need permanent coverage, you have the option to convert without needing to undergo medical underwriting, guaranteeing approval.

Disadvantages

- Potentially Higher Premiums After Conversion:Premiums may increase after conversion, depending on your age and health at the time.

- Limited Cash Value:Convertible life insurance doesn’t offer initial cash value, which can be a disadvantage if you need access to funds later.

Term Life Insurance

Advantages

- Affordable Premiums:Term life insurance offers the most affordable premiums among the three options, making it ideal for temporary coverage needs.

- Simple and Straightforward:It provides straightforward coverage for a specific period, making it easy to understand and manage.

Disadvantages

- Limited Coverage:Term life insurance only provides coverage for a specific term, after which it expires or needs to be renewed.

- No Cash Value:It doesn’t accumulate cash value, which can be a drawback if you need access to funds later.

- Renewing Premiums May Increase:Premiums may increase significantly when you renew your term life insurance policy, especially if you are older or have health issues.

Permanent Life Insurance

Advantages

- Lifetime Coverage:Permanent life insurance provides lifetime coverage, ensuring your beneficiaries receive a death benefit regardless of when you pass away.

- Cash Value Accumulation:It builds cash value that you can borrow against or withdraw, providing financial flexibility.

- Potential Investment Growth:Some permanent life insurance policies offer investment options, allowing your cash value to potentially grow over time.

Disadvantages

Suitability for Different Life Stages and Circumstances

The suitability of each life insurance type depends on your individual needs and circumstances:

Convertible Life Insurance

- Young Adults:Ideal for those starting their careers and families, providing affordable coverage with the option to convert later if their needs change.

- Individuals with Uncertain Future Needs:Suitable for those who are unsure about their long-term coverage requirements and want the flexibility to adapt later.

Term Life Insurance

- Individuals with Temporary Coverage Needs:Suitable for those needing coverage for a specific period, such as during a mortgage or child-rearing years.

- Budget-Conscious Individuals:Ideal for those seeking affordable coverage options with a focus on cost-effectiveness.

Permanent Life Insurance

- Individuals Seeking Lifetime Coverage:Suitable for those wanting guaranteed coverage for their entire life, providing peace of mind for their beneficiaries.

- Individuals with Estate Planning Needs:Ideal for those who want to use life insurance as part of their estate planning strategy, leaving a legacy for their loved ones.

- Individuals Seeking Wealth Accumulation:Suitable for those who want to build cash value and potentially invest their life insurance premiums.

Final Wrap-Up

Convertible life insurance is a powerful tool for navigating life’s uncertainties. It provides the flexibility to adapt your coverage as your needs evolve, offering peace of mind knowing you have the right protection for your family and your future. Whether you’re just starting out or looking for a way to solidify your financial security, exploring convertible life insurance options is a smart move.

It’s like having a safety net that grows with you, providing a secure foundation for your dreams and aspirations.

Common Queries

What are the main benefits of convertible life insurance?

Convertible life insurance offers several advantages, including flexibility, affordability, and the potential to lock in lower premiums during the term period. It allows you to adjust your coverage as your life changes, ensuring you always have the right protection.

How does the conversion process work?

Converting a term life insurance policy to a permanent policy usually involves contacting your insurance provider and providing them with your request. They will review your application and assess your health status. The conversion process typically has specific requirements and timelines that vary by insurer.

What factors should I consider when deciding if convertible life insurance is right for me?

It’s essential to consider your current and future financial needs, your age, health, and lifestyle when deciding if convertible life insurance is a good fit. You should also compare different policy types and their associated costs to find the best option for your situation.