Joint Life Insurance Policy is a unique type of insurance designed to protect two individuals simultaneously. Unlike individual policies, which cover a single person, joint life insurance provides a payout upon the death of either insured person. This makes it an invaluable tool for couples, business partners, or anyone who wants to ensure financial security for their loved ones in the event of a loss.

Joint life insurance policies offer a range of benefits, including estate planning, debt coverage, and financial stability for surviving beneficiaries. Whether you’re a married couple looking to secure your family’s future or business partners seeking to protect your company’s stability, understanding the different types and advantages of joint life insurance can provide you with the peace of mind you need.

Definition and Purpose of Joint Life Insurance

Joint life insurance is a type of life insurance policy that covers two or more individuals. It pays out a death benefit when the first insured person passes away. This type of policy is often used by couples who want to ensure that their surviving spouse has financial security in the event of the other spouse’s death.

Types of Joint Life Insurance

Joint life insurance policies are typically offered in two main types:

- First-to-die: This type of policy pays out the death benefit when the first insured person dies, regardless of the order of death. It’s often used for estate planning purposes, as it can help to avoid probate and reduce estate taxes.

- Second-to-die: This type of policy pays out the death benefit when the second insured person dies. It’s often used to cover the cost of a mortgage or other debts that may remain after the first spouse passes away.

Scenarios Where Joint Life Insurance Is Beneficial

Joint life insurance can be a valuable tool for couples who are looking to protect their financial future. Here are a few scenarios where this type of policy can be beneficial:

- Couples with young children: If one parent dies, the surviving parent will need to provide for their children financially. Joint life insurance can provide a death benefit that can help to cover expenses such as childcare, education, and living expenses.

- Couples with a mortgage: Joint life insurance can be used to pay off a mortgage if one spouse dies. This can help to ensure that the surviving spouse is not left with a large debt burden.

- Couples with a business: Joint life insurance can be used to provide financial support to a business if one of the owners dies. This can help to ensure that the business can continue to operate smoothly.

Types of Joint Life Insurance Policies: Joint Life Insurance Policy

Joint life insurance policies are designed to provide financial protection for two individuals, typically a married couple, upon the death of either insured. These policies offer various options, each tailored to specific needs and circumstances.

First-to-Die Policies

First-to-die policies, also known as joint first-to-die policies, pay out a death benefit upon the passing of the first insured individual. This type of policy is often chosen by couples who want to ensure financial security for the surviving spouse upon the death of the first spouse.

First-to-die policies are commonly used to cover the cost of funeral expenses, outstanding debts, or provide financial support for the surviving spouse.

Second-to-Die Policies

Second-to-die policies, also known as survivorship life insurance, are designed to pay out a death benefit only after the second insured individual passes away. These policies are typically used for estate planning purposes, as they can help to minimize estate taxes.

Second-to-die policies are often used to cover the estate tax liability that may arise when the second spouse dies, ensuring that the surviving heirs receive the full value of the estate.

Joint Survivorship Policies

Joint survivorship policies are a less common type of joint life insurance policy that provides coverage for both individuals until the death of the last surviving insured. These policies are typically more expensive than first-to-die or second-to-die policies because they offer coverage for a longer period.

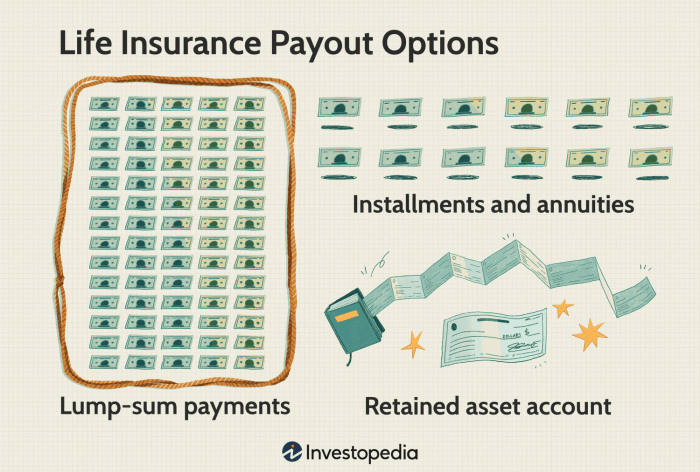

Joint survivorship policies are often used by couples who want to ensure that their beneficiaries receive a lump sum payment upon the death of the last surviving spouse.

Benefits of Joint Life Insurance

Joint life insurance offers numerous advantages for couples or business partners, providing financial security and peace of mind. This type of insurance policy is designed to pay out a death benefit upon the death of the first insured individual, ensuring financial stability for the surviving partner or business.

Financial Benefits

Financial benefits are a significant advantage of joint life insurance. This type of policy can provide financial support to the surviving spouse or business partner, ensuring their financial well-being during a difficult time.

- Estate Planning: Joint life insurance can be a valuable tool for estate planning, helping to ensure that the surviving spouse or business partner receives a lump sum death benefit. This benefit can be used to cover expenses, pay off debts, or provide financial security for the future.

For example, a couple could use joint life insurance to cover the cost of their mortgage or other outstanding debts, ensuring their surviving spouse can remain in their home.

- Debt Coverage: Joint life insurance can be used to cover debts that are jointly held by a couple or business partners. If one partner dies, the death benefit can be used to pay off the debt, relieving the surviving partner of this financial burden.

For example, a business partnership could use joint life insurance to cover the outstanding balance on a business loan, ensuring the surviving partner can continue to operate the business without facing significant financial hardship.

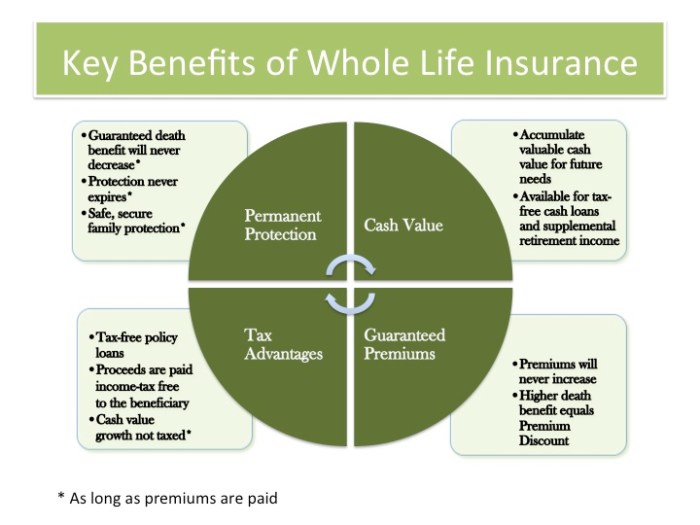

- Tax Advantages: In some cases, the death benefit from a joint life insurance policy may be tax-free. This can be a significant advantage, as it can help to minimize the tax burden on the surviving spouse or business partner. For example, if a couple has a large estate, the death benefit from their joint life insurance policy could be used to offset estate taxes, reducing the tax liability for their heirs.

A Joint Life Insurance Policy covers multiple lives, often a couple, providing a payout when the first person passes away. This can be particularly useful for couples who want to ensure their surviving spouse has financial security after the first death.

Thinking about retirement planning? You might want to check out What Is a Defined-Benefit Plan? , as it can help you plan for your future financial needs. A Joint Life Insurance Policy can be a valuable part of a comprehensive financial plan, especially when combined with other strategies like retirement savings plans.

Peace of Mind and Security

Joint life insurance can provide peace of mind and security for families and business partners, knowing that their loved ones or business will be financially protected in the event of their death.

- Financial Security: Joint life insurance provides financial security for the surviving spouse or business partner, ensuring their financial well-being in the event of the death of the first insured individual. This security can help to alleviate stress and anxiety during a difficult time, knowing that the surviving partner has the financial resources to meet their needs.

- Legacy Planning: Joint life insurance can be used to create a legacy for future generations. The death benefit can be used to provide financial support for children or grandchildren, ensuring their future well-being. For example, a couple could use joint life insurance to establish a trust fund for their children, providing them with financial security and opportunities for the future.

Considerations When Choosing Joint Life Insurance

Choosing a joint life insurance policy is a significant decision that requires careful consideration. It involves assessing your financial needs, understanding the different types of policies available, and evaluating the coverage amounts, premiums, and policy terms.

Coverage Amounts

Determining the appropriate coverage amount is crucial. It should be sufficient to meet your financial obligations in the event of the death of one or both insured individuals. Consider factors such as outstanding debts, mortgage payments, funeral expenses, and the financial needs of surviving dependents.

A financial advisor can help you estimate the required coverage amount based on your individual circumstances.

Premiums

Premiums are the regular payments you make for your joint life insurance policy. Factors that influence premiums include the age and health of the insured individuals, the coverage amount, and the policy term. It’s essential to compare premiums from different insurers to find the most affordable option without compromising coverage.

Consider the long-term cost of the policy and ensure it fits within your budget.

Policy Terms, Joint Life Insurance Policy

Policy terms refer to the duration of the coverage provided by the joint life insurance policy. Common types of policy terms include:

- Term Life Insurance:Provides coverage for a specific period, such as 10, 20, or 30 years. If the insured individuals die within the term, the death benefit is paid to the beneficiaries. However, no benefit is paid if they survive the term.

- Whole Life Insurance:Offers lifetime coverage, meaning the death benefit is paid to the beneficiaries regardless of when the insured individuals die. Whole life insurance policies also accumulate cash value that can be borrowed against or withdrawn.

- Universal Life Insurance:Provides flexible coverage and premiums. You can adjust the coverage amount and premiums based on your changing needs. Universal life insurance also accumulates cash value that earns interest.

Type of Policy

Choosing the right type of joint life insurance policy depends on your specific needs and circumstances. Consider factors such as:

- Financial Goals:If your primary goal is to provide a death benefit for your surviving spouse, a term life insurance policy might be sufficient. However, if you need a policy that accumulates cash value, whole or universal life insurance may be more appropriate.

- Budget:Term life insurance policies are generally more affordable than whole or universal life insurance policies. Consider your budget and choose a policy that you can comfortably afford.

- Health Status:If you or your spouse have pre-existing health conditions, you may have to pay higher premiums or be denied coverage altogether. Consider your health status when choosing a policy.

Joint Life Insurance and Estate Planning

Joint life insurance plays a crucial role in estate planning, offering a valuable tool for minimizing estate taxes and ensuring a smooth transfer of assets to beneficiaries. It provides financial security and helps families avoid potential financial burdens during a challenging time.

Estate Tax Minimization

Joint life insurance can be a strategic component of estate planning, particularly for individuals with substantial assets. When a policyholder passes away, the death benefit is typically exempt from estate taxes. This means that the beneficiary receives the full amount without any deductions for estate taxes, helping to preserve the wealth for future generations.

For example, a couple with a large estate could purchase a joint life insurance policy with a death benefit of $5 million. Upon the death of the first spouse, the death benefit would be distributed to the surviving spouse tax-free. This can help to minimize the estate tax liability upon the death of the second spouse, ensuring that a greater portion of their wealth is passed on to their heirs.

Smooth Transfer of Assets

Joint life insurance can facilitate a smooth transfer of assets, especially in situations where there are complex family dynamics or significant business interests. The death benefit can be used to cover estate taxes, outstanding debts, or provide liquidity for business succession planning.

- Business Succession:In the event of the death of a business owner, joint life insurance can provide the necessary funds for a smooth transition of ownership. The death benefit can be used to purchase the deceased owner’s shares, ensuring the business remains in the family or is transferred to a qualified successor.

- Debt Coverage:Joint life insurance can be used to pay off outstanding debts, such as mortgages, loans, or business obligations, upon the death of one or both policyholders. This can relieve financial pressure on surviving family members and ensure their financial stability.

- Estate Liquidity:Joint life insurance can provide immediate liquidity to an estate, allowing beneficiaries to access funds quickly and efficiently. This can be particularly beneficial for covering funeral expenses, legal fees, and other estate administration costs.

Incorporating Joint Life Insurance into Estate Plans

Joint life insurance can be incorporated into comprehensive estate plans in various ways, depending on individual circumstances and goals.

- Irrevocable Life Insurance Trust (ILIT):An ILIT is a trust that owns the joint life insurance policy and receives the death benefit. This can help to minimize estate taxes and provide flexibility in distributing the proceeds to beneficiaries.

- Revocable Living Trust:A revocable living trust can hold the joint life insurance policy and distribute the death benefit according to the terms of the trust agreement. This can provide control over how the proceeds are used and ensure they are distributed according to the policyholder’s wishes.

- Will or Testament:The death benefit from a joint life insurance policy can be specified in a will or testament, ensuring that the proceeds are distributed according to the policyholder’s instructions.

Joint Life Insurance and Business Ownership

Joint life insurance, beyond its personal applications, offers valuable tools for business owners. It can be a crucial component in ensuring business continuity, protecting partners’ interests, and facilitating smooth transitions during ownership changes.

Funding Buy-Sell Agreements

A buy-sell agreement is a legally binding contract that Artikels the procedures for transferring ownership interests in a business if a partner dies, retires, or becomes disabled. Joint life insurance can serve as a funding mechanism for these agreements.

- Death Benefit as Funding Source:The death benefit from a joint life insurance policy can provide the necessary funds for the surviving partner(s) to purchase the deceased partner’s ownership stake in the business. This ensures a smooth transition of ownership without disrupting operations or causing financial hardship for the surviving partners.

- Prevents Forced Sale:Without a buy-sell agreement and funding, the deceased partner’s interest in the business could be inherited by their heirs, potentially leading to unwanted outsiders taking control or forcing the surviving partners to sell the business.

Financial Protection for Business Partners

Joint life insurance provides financial protection for business partners in several ways.

- Loss of Income Replacement:If a business partner dies, the surviving partner(s) can use the death benefit to replace the deceased partner’s lost income, maintaining the financial stability of the business.

- Business Debt Repayment:The death benefit can also be used to repay business debts, preventing financial strain on the surviving partners and ensuring the business’s financial stability.

- Business Continuity:Joint life insurance can help ensure the continuity of the business by providing the financial resources necessary to cover operational costs, employee salaries, and other expenses during a time of transition.

Business Continuity and Succession Planning

Joint life insurance plays a vital role in facilitating business continuity and succession planning.

- Smooth Transitions:The death benefit can be used to purchase the deceased partner’s shares, ensuring a smooth transition of ownership and control without disrupting operations.

- Attracting Investors:A well-structured buy-sell agreement funded by joint life insurance can make a business more attractive to potential investors, demonstrating a clear succession plan and financial stability.

- Protecting Business Value:By preventing the forced sale of the business, joint life insurance helps protect the value of the business for the surviving partners and ensures its continued success.

Joint Life Insurance and Debt Coverage

Joint life insurance can serve as a crucial financial safety net, particularly when it comes to covering outstanding debts in the event of the death of one or both policyholders. By providing a lump sum death benefit, joint life insurance can help ensure that surviving loved ones are not burdened with the weight of significant financial obligations.

Types of Debt Covered by Joint Life Insurance

Joint life insurance can provide financial relief for a variety of debts, including:

- Mortgages: This is perhaps the most common use of joint life insurance. The death benefit can be used to pay off the remaining mortgage balance, ensuring that the surviving spouse or dependents can remain in their home without facing foreclosure.

- Loans: Joint life insurance can also cover outstanding loans, such as personal loans, auto loans, or student loans. This can prevent the surviving spouse from being responsible for repaying these debts.

- Business Debts: For business owners, joint life insurance can be used to cover outstanding business debts, such as loans, lines of credit, or other financial obligations. This can help ensure that the business can continue to operate smoothly in the event of the death of a key partner.

Examples of Debt Coverage with Joint Life Insurance

- Imagine a couple with a $300,000 mortgage and a $50,000 car loan. If one spouse passes away, the joint life insurance death benefit could be used to pay off the mortgage and the car loan, leaving the surviving spouse with no debt and a comfortable financial cushion.

- A small business owner may have a $100,000 loan to fund business operations. If the owner passes away, the business could face financial hardship. However, with joint life insurance, the death benefit can be used to repay the loan, ensuring that the business can continue to operate.

Cost and Affordability of Joint Life Insurance

Joint life insurance premiums are influenced by several factors, making it crucial to understand these aspects when evaluating the cost and affordability of this type of coverage. The premium calculation process involves assessing the risk associated with insuring both individuals, taking into account their age, health, and the coverage amount.

Factors Influencing Joint Life Insurance Costs

The cost of joint life insurance is influenced by various factors, including:

- Age of the insured individuals:Younger individuals generally have lower premiums compared to older individuals. This is because younger individuals have a longer life expectancy, reducing the risk for insurance companies.

- Health status of the insured individuals:Individuals with pre-existing health conditions may face higher premiums due to an increased risk of early death. Insurance companies assess health risks through medical exams and questionnaires.

- Coverage amount:The higher the coverage amount, the higher the premium. This reflects the increased financial obligation for the insurance company in case of death.

- Type of policy:Different types of joint life insurance policies have varying premium structures. For instance, a joint life policy with a death benefit payable upon the first death of the insured individuals may have a lower premium than a policy paying out upon the second death.

- Smoking habits:Smokers generally pay higher premiums than non-smokers, as smoking significantly increases the risk of health issues and premature death.

- Lifestyle choices:Certain lifestyle choices, such as risky hobbies or dangerous professions, can influence premiums. Insurance companies may assess these factors to determine the risk associated with insuring an individual.

Premium Calculation and Variations

Premiums for joint life insurance are calculated based on a combination of factors, including:

- Age and gender:Life expectancy varies based on age and gender, influencing the probability of death within a given period. Insurance companies use actuarial tables to estimate life expectancy and calculate premiums.

- Health status:As mentioned earlier, pre-existing health conditions can significantly impact premiums. Insurance companies use medical history and risk assessments to determine the probability of early death and adjust premiums accordingly.

- Coverage amount:The premium amount is directly proportional to the coverage amount. Higher coverage amounts imply a larger financial obligation for the insurance company in case of death, resulting in higher premiums.

Premiums can vary significantly based on these factors. For example, a healthy, non-smoking couple in their early 30s may pay significantly lower premiums than an older couple with pre-existing health conditions.

Tips for Finding Affordable Joint Life Insurance Options

Finding affordable joint life insurance requires careful planning and comparison:

- Shop around:Obtain quotes from multiple insurance companies to compare premiums and coverage options. Different companies have varying underwriting practices and pricing models.

- Consider your needs:Evaluate your specific financial needs and determine the appropriate coverage amount. Avoid over-insuring, as it can lead to unnecessary expenses.

- Explore different policy types:Different types of joint life insurance policies offer varying coverage options and premium structures. Compare the features and costs of each type to find the best fit for your needs.

- Improve your health:Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and avoiding smoking, can lower your risk profile and potentially reduce premiums.

- Negotiate premiums:Some insurance companies may be willing to negotiate premiums based on factors such as good health, a clean driving record, or a history of responsible financial behavior.

Conclusive Thoughts

Joint life insurance is a powerful financial tool that can provide significant benefits for both individuals and families. By carefully considering your needs, choosing the right type of policy, and understanding its implications, you can utilize joint life insurance to create a secure and stable future for your loved ones.

Whether you’re planning for your family’s financial well-being, ensuring business continuity, or simply seeking peace of mind, joint life insurance can be a valuable asset in your financial strategy.

Commonly Asked Questions

What are the main differences between joint life insurance and individual life insurance?

Joint life insurance covers two individuals, while individual life insurance covers only one. With joint life insurance, the death benefit is paid out upon the death of either insured person, while individual life insurance only pays out upon the death of the policyholder.

How does joint life insurance work for estate planning?

Joint life insurance can help minimize estate taxes by providing a lump sum payout that can be used to cover taxes and ensure a smooth transfer of assets to beneficiaries. This can be particularly beneficial for couples with significant assets.

What are some common scenarios where joint life insurance is most beneficial?

Joint life insurance is often used by married couples to cover mortgage payments or other debts, provide financial security for their children, or fund their estate plans. It’s also a valuable tool for business partners who want to ensure the continuity of their company in the event of one partner’s death.

Is joint life insurance more expensive than individual life insurance?

The cost of joint life insurance can vary depending on factors like the ages and health of the insured individuals, the coverage amount, and the type of policy. In some cases, joint life insurance may be more affordable than purchasing two separate individual policies.