What are car insurance quotes with discounts? They’re your secret weapon to getting the best possible price on your car insurance! Think of it like this: You’re a detective trying to uncover the lowest rates, and discounts are your clues.

By understanding the different types of discounts and how to qualify, you can unlock significant savings.

Imagine you’re cruising down the highway, but instead of gas, you’re burning through money on car insurance. Not cool, right? That’s where discounts come in. They’re like a magic potion that can transform your insurance bill from a budget buster to a bargain.

But don’t worry, we’ll break down the secrets of these discounts, so you can become a pro at saving!

Car Insurance Quotes: What Are Car Insurance Quotes With Discounts?

Car insurance quotes are estimates of how much you’ll pay for car insurance. They’re like a snapshot of the cost, but the actual price you end up paying might be slightly different.

Factors Influencing Car Insurance Quotes

Several factors can influence your car insurance quote, and it’s important to understand how these factors impact your premium.

- Your driving history:A clean driving record with no accidents or violations usually results in lower premiums.

- Your age and gender:Younger drivers, especially males, typically pay higher premiums due to higher risk factors.

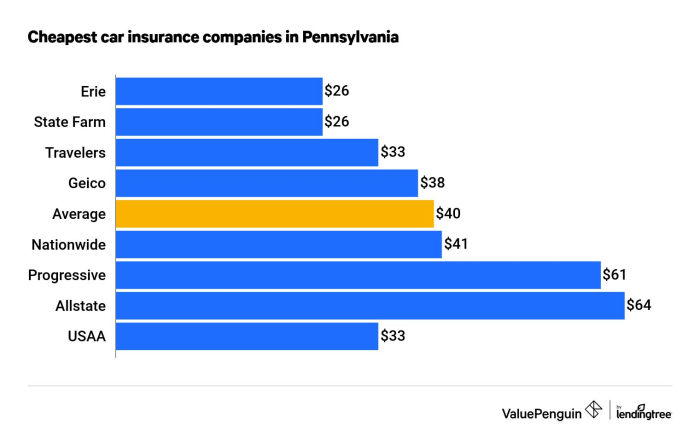

- Your location:The area where you live can affect your insurance rates. Cities with high traffic and crime rates may have higher insurance costs.

- Your car’s make and model:Certain car models are considered safer or more expensive to repair, influencing insurance rates.

- Your credit score:In some states, your credit score can be used to determine your insurance premiums.

- Your coverage options:Choosing higher coverage limits, such as comprehensive or collision coverage, can increase your premium.

- Your driving habits:Your driving habits, such as the number of miles you drive annually, can also influence your rates.

Common Insurance Discounts

Insurance companies often offer discounts to lower your premium.

- Good driver discount:This is typically offered to drivers with a clean driving record.

- Safe driver discount:This discount may be offered to drivers who complete a defensive driving course.

- Multi-car discount:You can get a discount if you insure multiple vehicles with the same company.

- Multi-policy discount:If you bundle your car insurance with other policies like homeowners or renters insurance, you may qualify for a discount.

- Anti-theft device discount:Installing anti-theft devices in your car, like alarms or tracking systems, can lead to a discount.

- Good student discount:This discount may be offered to students with good grades.

Common Car Insurance Discounts

Car insurance discounts are a great way to save money on your premiums. By taking advantage of these discounts, you can lower your overall costs and keep more money in your pocket.

Good Driver Discounts

Good driver discounts are among the most common and rewarding car insurance discounts. These discounts are awarded to drivers with a clean driving record, demonstrating their responsible driving habits and minimizing the risk of accidents.

- Eligibility: To qualify for a good driver discount, you must have a clean driving record, meaning no accidents, traffic violations, or other driving-related incidents within a specified period, usually three to five years.

- Benefits: Good driver discounts can significantly reduce your premiums. The exact discount amount varies depending on the insurance company and your specific driving history. For instance, some insurance providers might offer a 10% discount for drivers with no accidents or violations for five years, while others might offer a higher percentage for a longer period without incidents.

Safe Driver Discounts

Safe driver discounts are often offered to drivers who demonstrate safe driving practices, such as taking defensive driving courses or using telematics devices. These discounts recognize and reward drivers who proactively enhance their driving skills and prioritize road safety.

- Eligibility: To qualify for a safe driver discount, you may need to complete a certified defensive driving course, such as those offered by the American Automobile Association (AAA) or the National Safety Council. Some insurance companies also offer discounts for using telematics devices, which track your driving behavior, such as speed, braking, and acceleration, and provide feedback to help you improve your driving habits.

- Benefits: Safe driver discounts can significantly reduce your premiums. The discount amount can vary depending on the insurance company and the specific safe driving program you participate in. For instance, completing a defensive driving course might earn you a 10% discount, while using a telematics device might offer a 5% discount for safe driving habits.

Multi-Car Discounts

Multi-car discounts are a valuable option for families or individuals who insure multiple vehicles under the same policy. This discount recognizes the reduced risk associated with insuring multiple vehicles from the same household, as the insurance company can bundle the policies together and offer a discounted rate.

- Eligibility: To qualify for a multi-car discount, you must insure two or more vehicles under the same policy with the same insurance company. Some insurance companies might require the vehicles to be registered at the same address, while others might have less stringent requirements.

- Benefits: Multi-car discounts can significantly reduce your premiums. The discount amount can vary depending on the insurance company and the number of vehicles insured. For instance, you might receive a 10% discount for insuring two vehicles, and a 15% discount for insuring three vehicles, and so on.

Bundling Discounts

Bundling discounts are offered when you combine different insurance policies, such as car insurance, homeowners insurance, renters insurance, or life insurance, with the same insurance company. By bundling your policies, you can take advantage of lower premiums and enjoy the convenience of managing all your insurance needs under one roof.

- Eligibility: To qualify for a bundling discount, you must have multiple insurance policies with the same insurance company. The specific policies eligible for bundling can vary depending on the insurance company. For instance, some insurance companies might offer discounts for bundling car insurance and homeowners insurance, while others might offer discounts for bundling car insurance and renters insurance.

- Benefits: Bundling discounts can significantly reduce your premiums. The discount amount can vary depending on the insurance company and the specific policies you bundle. For instance, you might receive a 10% discount for bundling car insurance and homeowners insurance, and a 15% discount for bundling car insurance, homeowners insurance, and renters insurance.

Anti-theft Device Discounts

Anti-theft device discounts are offered to drivers who install anti-theft devices in their vehicles. These discounts recognize the reduced risk of theft associated with vehicles equipped with anti-theft devices, as these devices deter theft and help recover stolen vehicles.

- Eligibility: To qualify for an anti-theft device discount, you must install an approved anti-theft device in your vehicle. The specific devices eligible for discounts can vary depending on the insurance company. For instance, some insurance companies might accept alarm systems, immobilizers, or GPS tracking devices, while others might have specific requirements for the type of device and its installation.

- Benefits: Anti-theft device discounts can reduce your premiums. The discount amount can vary depending on the insurance company and the type of anti-theft device installed. For instance, you might receive a 5% discount for installing an alarm system, and a 10% discount for installing a GPS tracking device.

Payment Discounts

Payment discounts are offered to drivers who choose to pay their car insurance premiums in full or make regular, on-time payments. These discounts recognize the convenience and financial stability associated with paying premiums on time and in full, reducing the administrative costs for the insurance company.

- Eligibility: To qualify for a payment discount, you must choose to pay your car insurance premiums in full or make regular, on-time payments. Some insurance companies might offer discounts for paying annually, while others might offer discounts for making monthly payments without any late payments.

- Benefits: Payment discounts can reduce your premiums. The discount amount can vary depending on the insurance company and your payment method. For instance, you might receive a 5% discount for paying annually, and a 2% discount for making monthly payments without any late payments.

Loyalty Discounts

Loyalty discounts are offered to drivers who have been loyal customers of a particular insurance company for a certain period. These discounts reward customers for their continued business and recognize their trust and commitment to the insurance company.

- Eligibility: To qualify for a loyalty discount, you must have been a customer of the same insurance company for a specific period, typically five to ten years. The exact period required can vary depending on the insurance company.

- Benefits: Loyalty discounts can reduce your premiums. The discount amount can vary depending on the insurance company and the length of your relationship with the company. For instance, you might receive a 5% discount for being a customer for five years, and a 10% discount for being a customer for ten years.

Student Discounts

Student discounts are offered to students who maintain good grades and are enrolled in college or university. These discounts recognize the reduced risk associated with students who demonstrate academic achievement and responsibility.

- Eligibility: To qualify for a student discount, you must be enrolled full-time in an accredited college or university and maintain a minimum GPA, typically a 3.0 or higher. Some insurance companies might require you to be a certain age, such as under 25, to qualify for the discount.

- Benefits: Student discounts can reduce your premiums. The discount amount can vary depending on the insurance company and your academic achievements. For instance, you might receive a 5% discount for maintaining a 3.0 GPA, and a 10% discount for maintaining a 3.5 GPA.

Military Discounts

Military discounts are offered to active-duty military personnel, veterans, and their families. These discounts recognize the service and sacrifices of military members and their families.

- Eligibility: To qualify for a military discount, you must be an active-duty military member, a veteran, or a member of a military family. Some insurance companies might require you to provide proof of military service, such as a military ID or discharge papers.

- Benefits: Military discounts can reduce your premiums. The discount amount can vary depending on the insurance company and your military status. For instance, you might receive a 5% discount for being an active-duty military member, and a 10% discount for being a veteran.

Obtaining Car Insurance Quotes with Discounts

Now that you understand the types of car insurance discounts available, let’s explore how to actually get quotes that reflect these savings. The process is straightforward and can be done entirely online, saving you time and effort.

Car insurance quotes with discounts can be a real lifesaver for your wallet! But figuring out which discounts you qualify for can feel like deciphering a secret code. Luckily, there are resources out there that can help you navigate the world of car insurance discounts.

For example, you can check out this article on what are the best low-cost car insurance quotes to see what kind of deals are out there. By comparing quotes and understanding your options, you can find the best car insurance quote with discounts to fit your needs and budget.

Getting Car Insurance Quotes, What are car insurance quotes with discounts?

To obtain car insurance quotes, you’ll need to provide some basic information about yourself and your vehicle. This typically includes:

- Your name, address, and date of birth

- Your driving history, including any accidents or violations

- The make, model, and year of your vehicle

- Your desired coverage levels (liability, collision, comprehensive, etc.)

Once you provide this information, insurance companies will use their algorithms to calculate your premium and provide you with a quote.

Leveraging Discounts When Requesting Quotes

You can significantly reduce your car insurance premiums by taking advantage of available discounts. Here’s how to do it:

- Be upfront about your eligibility.When filling out the quote request form, clearly state any discounts you qualify for. For instance, if you’re a good student, have a clean driving record, or have multiple vehicles insured with the same company, mention these factors.

- Provide accurate information.Ensuring that all the information you provide is accurate and up-to-date is crucial. Providing incorrect details can result in inaccurate quotes and potential issues later.

- Ask about additional discounts.Don’t hesitate to inquire about discounts that might not be automatically included in the initial quote. These could include discounts for safety features, anti-theft devices, or even loyalty programs.

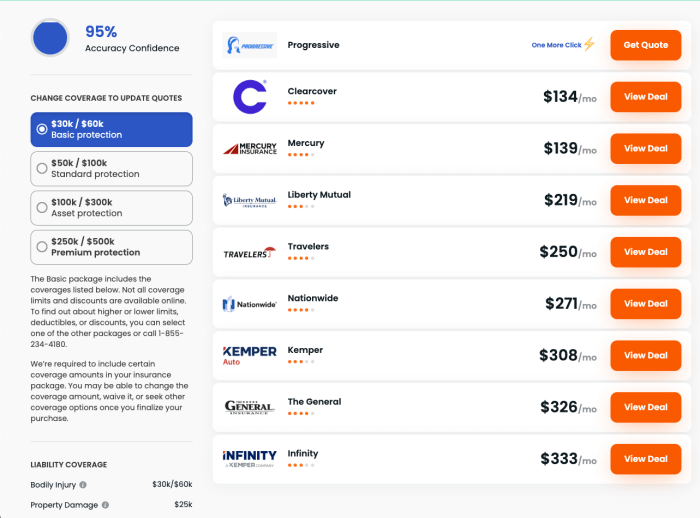

Comparing Quotes from Multiple Insurers

It’s essential to compare quotes from multiple insurers to ensure you’re getting the best possible price. Don’t settle for the first quote you receive.

“Comparing quotes from different insurers can save you hundreds, even thousands of dollars per year on your car insurance.”

You can easily compare quotes online using comparison websites or by contacting insurance companies directly.

Tips for Maximizing Car Insurance Discounts

Unlocking the full potential of car insurance discounts can significantly reduce your annual premiums. By understanding the various discount categories and implementing smart strategies, you can potentially save hundreds of dollars each year. Let’s explore practical tips to maximize your savings.

Improving Driving Records

A clean driving record is a cornerstone of securing substantial discounts. Insurance companies often reward drivers with a history of safe driving by offering lower premiums. Here’s how you can improve your driving record and qualify for these discounts:

- Defensive Driving Courses:Enroll in a certified defensive driving course. These courses teach safe driving techniques and can reduce your insurance premiums by demonstrating your commitment to safe driving.

- Maintain a Clean Driving Record:Avoid traffic violations, accidents, and other driving infractions. A clean driving record is essential for qualifying for good driver discounts.

- Consider a Telematics Program:Many insurance companies offer telematics programs that track your driving habits. By demonstrating safe driving behavior, you can earn discounts based on your performance.

Improving Vehicle Safety

Investing in vehicle safety features can not only enhance your safety but also earn you valuable discounts. Insurance companies recognize the value of safety features and often offer discounts for vehicles equipped with them.

- Anti-theft Devices:Installing anti-theft devices like alarms, immobilizers, and tracking systems can reduce the risk of theft and earn you a discount.

- Advanced Safety Features:Vehicles with features like lane departure warning, automatic emergency braking, and blind spot monitoring often qualify for significant discounts.

- Airbags and Seatbelts:Ensure your vehicle has the maximum number of airbags and that all occupants consistently use seatbelts. These features contribute to safety and can lead to discounts.

Bundling Insurance Policies

Bundling multiple insurance policies with the same insurer can often result in substantial savings. Insurance companies often offer discounts for bundling policies like car insurance, homeowners insurance, renters insurance, or life insurance.

- Compare Bundled Rates:Obtain quotes from different insurers to compare bundled rates and determine the most cost-effective option.

- Review Policy Coverage:Ensure the bundled policies provide the appropriate coverage for your needs.

- Negotiate Discounts:Don’t hesitate to negotiate with your insurer for additional discounts or better rates when bundling multiple policies.

Understanding Discount Restrictions and Exclusions

While car insurance discounts can significantly reduce your premiums, it’s crucial to understand their limitations and exclusions. These restrictions ensure fairness and prevent individuals from exploiting discounts for personal gain. Many factors can affect your eligibility for a discount, and it’s essential to understand these conditions before assuming you qualify.

Common Discount Limitations and Exclusions

It’s important to be aware of the common limitations and exclusions associated with car insurance discounts. These restrictions help ensure fairness and prevent individuals from exploiting discounts for personal gain. Here are some examples of common discount limitations and exclusions:

- Good Student Discount:This discount often applies to students with a certain GPA, but may have age restrictions. For instance, it might only apply to students under 25 years old.

- Safe Driver Discount:This discount typically requires a clean driving record for a specific period, often 3-5 years. It may not apply if you have had recent accidents, traffic violations, or DUI convictions.

- Multi-Car Discount:This discount often applies to multiple vehicles insured with the same company, but it might have restrictions based on the age and type of vehicles.

- Anti-theft Device Discount:This discount may require specific anti-theft devices to be installed and certified, and the devices might need to meet certain standards.

- Low Mileage Discount:This discount typically applies to drivers who drive fewer miles annually, but may have restrictions on the maximum mileage allowed to qualify.

Scenarios Where Discounts May Not Apply

Certain situations can prevent you from qualifying for specific discounts, even if you meet other requirements.

- Recent Accidents or Violations:Even if you have a generally clean driving record, recent accidents or traffic violations might disqualify you from certain discounts, particularly those related to safe driving.

- Driving History in Other States:Your driving history in other states can impact your eligibility for discounts. If you have a history of accidents or violations in another state, it might affect your discount eligibility in your current state.

- Vehicle Modifications:Modifying your vehicle can affect your insurance coverage and discounts. For example, installing aftermarket parts or modifying the engine might void certain discounts or even increase your premium.

- Changes in Your Driving Habits:If your driving habits change significantly, such as starting a new job with a long commute or driving more frequently, it might affect your eligibility for certain discounts, such as the low mileage discount.

Importance of Reading Policy Terms and Conditions Carefully

To ensure you fully understand the terms and conditions of your car insurance policy, including discount eligibility, it’s crucial to read them carefully.

“Reading your policy is essential for understanding your coverage and ensuring you are maximizing your benefits. Don’t just assume you qualify for discounts without verifying the specific requirements.”

By carefully reviewing your policy documents, you can avoid surprises and ensure you are receiving all the discounts you qualify for.

Conclusion (Optional)

Securing the best car insurance rates often involves a strategic approach. Understanding the various discounts available can significantly reduce your premiums. By exploring your eligibility for discounts and comparing quotes from multiple insurers, you can find the most affordable and comprehensive coverage for your needs.

Key Takeaways

Remember these key points:

- Discounts can substantially reduce your car insurance premiums.

- Several factors influence your eligibility for discounts, including your driving history, vehicle type, and location.

- Comparing quotes from multiple insurers is crucial to find the best rates.

- By actively seeking out discounts and comparing quotes, you can save money on your car insurance.

Last Recap

So, you’ve got the lowdown on car insurance discounts, now it’s time to put your detective skills to the test! Arm yourself with knowledge about the different types, how to qualify, and how to compare quotes. Remember, the key to saving money is to be informed and proactive.

Now, go out there and unlock those savings! Your wallet will thank you.

Question & Answer Hub

What’s the best way to compare car insurance quotes?

Use online comparison websites or contact multiple insurance companies directly. Be sure to provide the same information to each insurer for an accurate comparison.

Can I get discounts if I’m a new driver?

Yes, some insurers offer discounts for new drivers who have completed a defensive driving course or have a good driving record.

What if I don’t qualify for any discounts?

Don’t worry, there’s always something you can do! Consider bundling your car insurance with other policies like homeowners or renters insurance, or explore discounts based on your car’s safety features.