What are car insurance quotes with discounts? It’s a question that sparks curiosity in every driver’s mind. We all want the best possible rates, and knowing how to unlock those discounts can save you a bundle. From your driving record to the safety features in your car, there’s a whole world of discounts waiting to be discovered.

Let’s dive in and explore how you can snag the best deals on your car insurance.

Imagine this: you’re cruising down the highway, feeling confident and safe, knowing you’ve got the right insurance coverage at a price that fits your budget. That’s the power of car insurance discounts! But how do you find these hidden gems?

What kind of discounts are even available? We’ll cover it all, from good driver discounts to those based on your car’s features, and even those for bundling your insurance policies. Get ready to unlock the secrets to saving big on your car insurance.

Introduction to Car Insurance Quotes

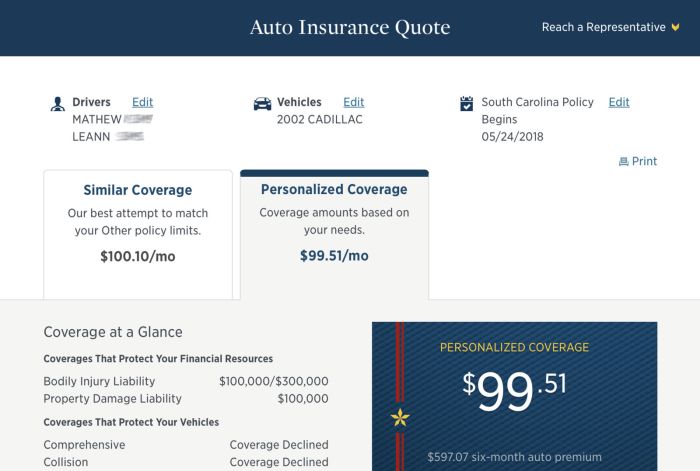

Car insurance quotes are estimates of how much you’ll pay for car insurance coverage. They are essential for comparing different insurance policies and finding the best deal for your needs. Understanding car insurance quotes can help you make informed decisions about your insurance coverage and potentially save money.

Factors Influencing Car Insurance Quotes

Several factors contribute to variations in car insurance quotes. These factors are used by insurance companies to assess your risk and determine your premium.

- Driving History:Your driving record, including accidents, violations, and driving experience, significantly influences your quote. A clean driving record typically results in lower premiums.

- Vehicle Information:The make, model, year, and safety features of your car play a crucial role in determining your insurance cost. Newer vehicles with advanced safety features tend to have lower premiums due to their safety record and potential for lower repair costs.

- Location:Your location, including the city, state, and zip code, affects your insurance rates. Areas with higher accident rates or theft rates typically have higher insurance premiums.

- Coverage Options:The type and amount of coverage you choose influence your premium. For instance, comprehensive and collision coverage, which cover damage to your car, are generally more expensive than liability coverage, which covers damage to other vehicles or property.

- Credit Score:In many states, insurance companies use your credit score to assess your risk. Individuals with good credit scores often receive lower premiums.

Common Insurance Discounts

Insurance companies offer various discounts to incentivize safe driving practices and reduce risk. These discounts can significantly lower your premiums.

Car insurance quotes with discounts can be a real lifesaver, especially if you’re looking to save some serious cash. But did you know that military members often qualify for even better rates? Head over to What are the best car insurance quotes for military members?

to learn more about these special offers, and then come back to us for more tips on how to find the best car insurance quotes with discounts for you!

- Good Driver Discount:This discount is awarded to drivers with clean driving records and no accidents or violations.

- Safe Driver Discount:This discount is offered to drivers who complete defensive driving courses or have a good driving record.

- Multi-Car Discount:You can save money by insuring multiple vehicles with the same insurance company.

- Multi-Policy Discount:You may receive a discount for bundling your car insurance with other insurance policies, such as homeowners or renters insurance.

- Anti-theft Device Discount:Installing anti-theft devices, such as alarms or GPS tracking systems, can lower your premium.

- Loyalty Discount:Insurance companies often reward long-term customers with discounts for their loyalty.

Types of Car Insurance Discounts

Car insurance discounts can significantly reduce your premiums. These discounts are offered by insurance companies to reward policyholders for specific characteristics or behaviors that reduce the risk of accidents. Understanding these discounts can help you save money on your car insurance.

Good Driver Discounts

These discounts are awarded to drivers with a clean driving record, demonstrating their responsible driving habits.

- Safe Driving Record:Drivers with no accidents or traffic violations in a specific period (usually 3 to 5 years) qualify for this discount. This demonstrates a consistent history of safe driving.

- Defensive Driving Course Completion:Completing a certified defensive driving course can lower your premiums. These courses teach safe driving practices and techniques, reducing the risk of accidents.

Vehicle-Related Discounts

These discounts relate to the type of car you drive and its safety features.

- Anti-theft Device Discount:Installing anti-theft devices, such as alarms, immobilizers, or GPS trackers, can make your car less attractive to thieves, reducing the risk of theft and qualifying you for this discount.

- New Car Discount:New cars often come with advanced safety features, making them safer to drive. Insurance companies often offer discounts for newer vehicles.

- Safety Feature Discount:Cars equipped with safety features like airbags, anti-lock brakes, and electronic stability control are generally safer, leading to lower insurance premiums.

Other Discounts

- Multi-Policy Discount:Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. Insurance companies often reward customers who insure multiple vehicles with them.

- Good Student Discount:Students with good grades (usually a GPA of 3.0 or higher) are often eligible for discounts. This discount is based on the assumption that good students tend to be responsible and make safe choices.

- Military Discount:Active military personnel and veterans often qualify for discounts. This acknowledges their service and potential lower risk profile.

Good Driver Discounts

Safe driving habits are not only beneficial for your own well-being but also for your wallet. Insurance companies recognize and reward drivers who demonstrate responsible driving practices through good driver discounts. These discounts can significantly reduce your car insurance premiums, making safe driving a financially rewarding decision.

Impact of Driving Records on Insurance Quotes, What are car insurance quotes with discounts?

Driving records are the primary factor influencing good driver discounts. Insurance companies meticulously analyze your driving history to assess your risk profile. A clean driving record with no accidents, violations, or claims is the most desirable scenario. Conversely, a history of accidents, speeding tickets, or other violations will likely result in higher premiums and potentially disqualify you from certain discounts.

Good Driver Discount Comparison

Here’s a comparison of good driver discounts offered by different insurance companies:

| Insurance Company | Discount Type | Discount Percentage | Eligibility Criteria |

|---|---|---|---|

| Progressive | Safe Driver Discount | Up to 15% | No accidents or violations in the past 3 years |

| Geico | Good Driver Discount | Up to 10% | No accidents or violations in the past 5 years |

| State Farm | Defensive Driving Discount | Up to 10% | Completion of a certified defensive driving course |

| Allstate | Good Driver Discount | Up to 15% | No accidents or violations in the past 3 years |

Vehicle-Related Discounts

Car insurance companies often offer discounts based on the type of vehicle you drive. These discounts can significantly reduce your premium, so it’s essential to understand how they work.

Discounts Based on Vehicle Features

Vehicle features can influence your insurance premium. Certain features are considered safer or less likely to be involved in accidents, making them more attractive to insurance companies.

- Anti-theft Devices:Cars equipped with anti-theft devices like alarms, immobilizers, and GPS tracking systems are less likely to be stolen. These features can significantly reduce your premium.

- Safety Features:Vehicles with advanced safety features, such as anti-lock brakes (ABS), electronic stability control (ESC), and airbags, are often rewarded with discounts. These features can mitigate the severity of accidents and reduce the risk of injuries.

- Advanced Driver-Assistance Systems (ADAS):Features like lane departure warning, blind spot monitoring, and adaptive cruise control can further reduce your risk of accidents. Insurance companies recognize these systems’ value and often offer discounts.

Discounts Based on Vehicle Safety Ratings

Insurance companies often reward vehicles with high safety ratings. These ratings are based on independent testing conducted by organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA).

- IIHS Top Safety Pick+:Vehicles earning the IIHS Top Safety Pick+ designation are considered among the safest on the road. These vehicles typically have excellent crash test performance and advanced safety features.

- NHTSA 5-Star Safety Rating:The NHTSA’s 5-Star Safety Rating system evaluates vehicles based on their performance in crash tests. Vehicles receiving a 5-Star rating demonstrate exceptional safety performance.

Discounts for Vehicle Type

The type of vehicle you drive can also influence your insurance premium.

- Hybrid and Electric Vehicles:These vehicles are often considered more environmentally friendly and efficient, and insurance companies may offer discounts due to their lower risk of accidents.

- Small Cars:Small cars are typically less expensive to repair than larger vehicles, which can result in lower insurance premiums.

- Older Vehicles:Older vehicles may have lower insurance premiums due to their depreciated value. However, they may not have the same safety features as newer models, so you might pay more for comprehensive and collision coverage.

Example of Vehicle-Related Discounts

Here are some examples of specific vehicle-related discounts offered by insurance companies:

| Discount Type | Description | Example |

|---|---|---|

| Anti-theft Device Discount | Discount for vehicles equipped with anti-theft devices. | 10% discount for cars with a factory-installed alarm system. |

| Safety Feature Discount | Discount for vehicles with advanced safety features. | 5% discount for cars with anti-lock brakes (ABS) and electronic stability control (ESC). |

| Safety Rating Discount | Discount for vehicles with high safety ratings. | 15% discount for vehicles earning the IIHS Top Safety Pick+ designation. |

| Hybrid/Electric Vehicle Discount | Discount for vehicles powered by hybrid or electric technology. | 10% discount for cars with a hybrid or electric powertrain. |

Loyalty and Bundling Discounts

Insurance companies often reward their loyal customers with discounts. These discounts can be significant, and they can help you save money on your car insurance premiums.Loyalty discounts are a way for insurance companies to show appreciation for their long-term customers.

By offering discounts to customers who have been with them for a certain period, insurance companies can encourage customer retention and build strong relationships.

Loyalty Discounts

Insurance companies often offer loyalty discounts to customers who have been with them for a certain period. The length of time required to qualify for a loyalty discount varies by insurer, but it is typically at least one year. For example, some insurance companies may offer a 5% discount to customers who have been with them for two years, a 10% discount to customers who have been with them for five years, and a 15% discount to customers who have been with them for ten years.

Bundling Discounts

Bundling discounts are another way to save money on your car insurance premiums. Bundling is when you combine multiple insurance policies, such as car insurance, home insurance, and renters insurance, with the same insurance company. By bundling your policies, you can often get a discount on your premiums.

The discount you receive will vary depending on the insurance company and the policies you bundle.

Bundling discounts can save you money on your insurance premiums by allowing insurance companies to offer you a lower rate on your policies.

Bundling Different Types of Insurance

Bundling discounts can be applied to various types of insurance, including:

- Car insurance and home insurance

- Car insurance and renters insurance

- Car insurance and life insurance

- Car insurance and health insurance

The discount you receive for bundling will depend on the insurance company and the policies you bundle. For example, you may receive a larger discount for bundling your car insurance and home insurance than for bundling your car insurance and life insurance.

Other Common Discounts

While we’ve covered some of the most common car insurance discounts, there are other ways to save money on your premiums. These discounts might not be as widely advertised but can still make a significant difference in your overall cost.

Let’s explore some of these additional discounts that could help you save.

Student Discounts

If you’re a full-time student, you might be eligible for a student discount on your car insurance. Insurance companies often offer this discount because students generally drive less and are considered to be less risky drivers than other demographics. This discount is usually available to students who maintain a good academic record and are under a certain age.

Military Discounts

Many insurance companies offer discounts to active-duty military personnel and veterans. These discounts are a way for insurance companies to show their appreciation for the service and sacrifice of our military members. Discounts can vary depending on the insurer and the specific military branch, but they often include premium reductions, waived fees, or other perks.

Group Discounts

Some insurance companies offer discounts to members of certain groups or organizations. These groups could be professional associations, alumni associations, or even employees of specific companies. This type of discount is often offered because insurance companies recognize that members of these groups tend to have certain shared characteristics, such as a higher level of education or income, which can make them less risky to insure.

- Professional Associations: Organizations like the American Medical Association or the American Bar Association may offer group discounts to their members.

- Alumni Associations: Graduates of universities or colleges may be eligible for discounts through their alumni associations.

- Employee Groups: Some companies offer group discounts to their employees through partnerships with insurance providers.

Finding and Applying for Discounts

The process of securing car insurance quotes with discounts involves a combination of proactive research, careful communication, and strategic application. It’s like a treasure hunt, where you need to uncover the hidden gems of savings offered by insurance companies.

Identifying Available Discounts

Identifying available discounts begins with understanding the various types of discounts offered by insurance providers. These can be broadly categorized into good driver discounts, vehicle-related discounts, loyalty and bundling discounts, and other common discounts. Once you’ve grasped these categories, the next step is to explore specific discounts offered by different insurance companies.

This involves:

- Visiting insurance company websites:Most insurance companies provide detailed information about their discounts on their websites. Look for sections like “Discounts” or “Savings” to find a comprehensive list.

- Contacting insurance agents:Don’t hesitate to call or email insurance agents to inquire about available discounts. They can provide personalized information and guidance based on your specific circumstances.

- Comparing quotes:When comparing quotes from different insurers, pay close attention to the discounts mentioned. This allows you to identify companies offering the most attractive deals.

Maximizing Discounts

Once you’ve identified potential discounts, it’s crucial to maximize your chances of securing them. This involves:

- Providing accurate information:Ensure you provide accurate and complete information when applying for discounts. For example, if you’re eligible for a good driver discount, provide proof of your clean driving record.

- Meeting eligibility criteria:Each discount has specific eligibility criteria. Make sure you meet these criteria to qualify. For instance, some discounts might require you to install safety features in your car.

- Negotiating with insurance companies:Don’t be afraid to negotiate with insurance companies. If you’re eligible for multiple discounts, you can try to negotiate a lower overall premium.

Securing the Best Rates

To secure the best possible rates, follow these tips:

- Shop around:Don’t settle for the first quote you receive. Compare quotes from multiple insurance companies to ensure you’re getting the most competitive rates.

- Consider bundling:If you have multiple insurance policies, such as home, auto, or renters insurance, consider bundling them with the same insurer. This can often lead to significant savings.

- Review your policy regularly:Your insurance needs may change over time. Review your policy periodically to ensure you’re still getting the best coverage and discounts available.

Concluding Remarks

So, there you have it! Armed with this knowledge, you’re ready to conquer the world of car insurance quotes and discounts. Remember, it’s all about being proactive and doing your research. By understanding the various discounts available and how to qualify for them, you can significantly reduce your premiums and keep more money in your pocket.

Don’t be afraid to ask questions, compare quotes, and explore all your options. Happy savings!

General Inquiries: What Are Car Insurance Quotes With Discounts?

What if I’m a new driver? Are there any discounts for me?

Absolutely! Some insurance companies offer discounts for new drivers who have completed a driver’s education course or have good grades in school.

How do I know if I’m eligible for a discount?

The best way to find out is to contact your insurance company or use an online quote tool. They can provide a personalized list of discounts you may qualify for.

What if I don’t have a good driving record?

Even if you have a few minor traffic violations, you may still qualify for discounts. Some companies offer discounts for drivers who have completed defensive driving courses.