What are full coverage car insurance quotes? They’re the price tag for a comprehensive insurance policy that safeguards you against a wide range of financial risks, from collisions and theft to natural disasters and vandalism. Imagine your car, gleaming and pristine, suddenly facing a fender bender or a hailstorm – full coverage is your financial safety net in such situations.

It’s about peace of mind, knowing you’re covered if the unexpected strikes.

This guide will take you through the ins and outs of full coverage car insurance, from understanding the coverage components to comparing quotes and making informed decisions.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive package designed to protect you financially in the event of an accident or other unforeseen circumstances involving your vehicle. It combines multiple types of coverage to provide a robust safety net, ensuring you’re covered for a wide range of potential risks.

Types of Coverage Included in Full Coverage Policies

Full coverage policies typically include a combination of several essential coverages. Understanding the purpose of each coverage type can help you make informed decisions about your insurance needs.

- Liability Coverage: This is the most fundamental part of car insurance, providing financial protection if you’re at fault in an accident causing damage to another person’s property or injuries. It covers legal expenses, medical bills, and property damage up to the policy limits.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault. It’s crucial for protecting your investment in your car.

- Comprehensive Coverage: This coverage safeguards you against damage to your vehicle from non-collision events such as theft, vandalism, fire, hail, or natural disasters. It’s essential for protecting your vehicle from unexpected events.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you’re involved in an accident with a driver who lacks adequate insurance or is uninsured altogether. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, often mandatory in certain states, pays for your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. It helps ensure you receive prompt medical attention and financial support during recovery.

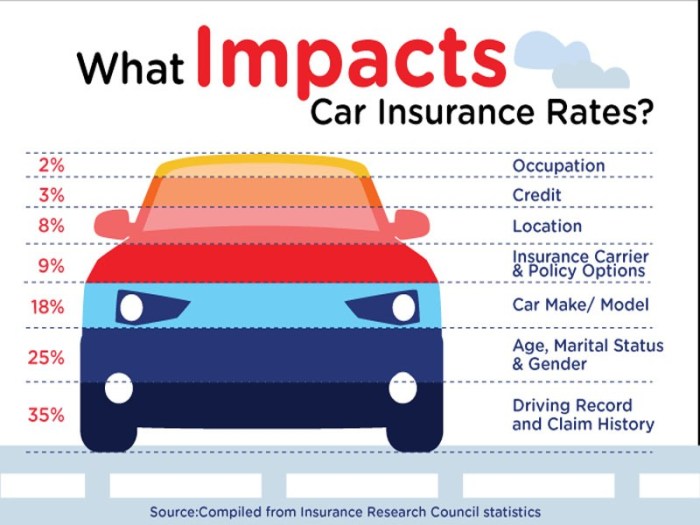

Factors Influencing Full Coverage Quotes

Your full coverage car insurance quote isn’t just a random number pulled out of a hat. It’s carefully calculated based on a variety of factors that insurers use to assess your risk. Let’s delve into the key factors that influence your full coverage car insurance quote.

Vehicle Details

The car you drive plays a significant role in determining your insurance premium. Insurers consider various aspects of your vehicle to assess its risk profile.

- Make and Model:Certain car brands and models are known for their safety features, reliability, and repair costs. For example, a luxury sports car with a high repair cost might have a higher insurance premium than a reliable, fuel-efficient compact car.

- Year:Newer cars often come with advanced safety features and have better crashworthiness ratings, which can translate into lower insurance premiums. Older vehicles, on the other hand, might have higher premiums due to their increased risk of breakdowns and potential for costly repairs.

- Safety Features:Cars equipped with safety features like anti-lock brakes, airbags, and electronic stability control are generally considered safer, leading to lower insurance premiums.

Driver Characteristics

Beyond your vehicle, your personal characteristics also play a crucial role in shaping your insurance quote. Insurers consider factors like:

- Age:Younger drivers with less experience are statistically more likely to be involved in accidents, leading to higher premiums. As drivers gain experience and age, their premiums tend to decrease.

- Driving History:Your driving record is a key factor. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents, traffic violations, or DUI convictions, your insurance rates will likely be higher.

- Location:The area where you live can impact your insurance rates. Areas with high crime rates, congested traffic, or a higher frequency of accidents may have higher insurance premiums.

Obtaining Full Coverage Quotes: What Are Full Coverage Car Insurance Quotes?

Now that you understand what full coverage car insurance is and the factors that affect its cost, it’s time to start getting quotes! This is the exciting part where you can see how much different insurers value your car and driving record.

Methods for Obtaining Quotes

There are a few different ways to get quotes for full coverage car insurance. Here’s a breakdown of the most common methods:

- Contacting Insurance Companies Directly: This involves reaching out to each insurer individually through their website, phone, or email. This gives you direct access to their policies and allows for personalized conversations with their representatives.

- Using Online Platforms: Several websites like Policygenius, Insurance.com, and The Zebra act as comparison tools, allowing you to enter your information once and receive quotes from multiple insurers. This method saves time and effort, but may not offer the same level of personalization as direct contact.

- Working with Insurance Brokers: Brokers act as intermediaries, helping you find the best coverage from various insurers. They can provide expert advice and handle the paperwork, but they might charge a fee for their services.

Just like you’d want to know the cost of protecting your car with full coverage insurance, it’s smart to consider the cost of protecting your loved ones with a Joint Life Insurance Policy. This type of policy can offer peace of mind knowing that financial support will be there for your family if something unexpected happens to you or your partner.

So, while you’re getting quotes for your car insurance, take a minute to explore the options for life insurance too!

Comparison of Quote Providers

Here’s a table comparing the different methods for obtaining full coverage car insurance quotes:

| Method | Benefits | Drawbacks |

|---|---|---|

| Directly Contacting Insurance Companies | Personalized communication, direct access to insurer’s policies, potential for negotiation. | Time-consuming, requires contacting multiple insurers individually. |

| Online Platforms | Saves time, provides quotes from multiple insurers in one place, convenient and user-friendly. | Limited personalization, may not offer the most competitive rates, potential for data privacy concerns. |

| Insurance Brokers | Expert advice, handles paperwork, access to a wide range of insurers. | May charge a fee, might not have access to all insurers, potential for bias towards specific insurers. |

Comparing Full Coverage Quotes

Shopping around for car insurance is crucial to finding the best deal for your needs. It’s like trying on different shoes before committing to a pair – you want to make sure the fit is right and the price is reasonable.

Comparing full coverage quotes from multiple providers can save you a significant amount of money in the long run.

Comparing Full Coverage Quotes Effectively

Comparing quotes from different providers is the best way to ensure you’re getting the most competitive price. This process can be time-consuming, but it’s worth the effort. Here’s a step-by-step guide to effectively compare full coverage quotes:

- Gather Your Information:Before you start, have all your relevant information ready. This includes your driving history, vehicle information (make, model, year), and any other factors that might influence your insurance rate, such as your credit score or location.

- Use Online Comparison Tools:Many websites offer online car insurance comparison tools. These tools allow you to enter your information once and get quotes from multiple providers simultaneously. This saves you time and effort compared to contacting each provider individually.

- Contact Insurance Providers Directly:After using comparison tools, it’s still a good idea to contact some providers directly. This allows you to discuss your specific needs and get personalized quotes. It’s also a good opportunity to ask questions about coverage options and discounts.

- Compare Quotes Side-by-Side:Once you have a few quotes, carefully compare them. Consider factors like the premium, coverage options, deductibles, and customer service ratings. Remember that the cheapest option isn’t always the best. Make sure the coverage is adequate for your needs and that the provider has a good reputation for customer service.

Factors to Consider When Choosing a Policy

When comparing quotes, don’t just focus on the price. Here are some important factors to consider:

- Coverage Options:Ensure the policy covers your specific needs. For example, if you have a newer car, you might want to consider a policy with comprehensive and collision coverage. These cover damage to your car due to incidents like theft or accidents.

- Deductibles:A deductible is the amount you pay out-of-pocket before your insurance covers the rest. A higher deductible typically means a lower premium, but you’ll have to pay more if you need to file a claim. Choose a deductible you can comfortably afford in case of an accident.

- Customer Service:Look for a provider with a good reputation for customer service. You want to be able to easily contact them with questions or concerns and receive prompt and helpful assistance.

- Discounts:Many providers offer discounts for good driving records, safety features in your car, and bundling multiple insurance policies (like home and auto). Ask about available discounts to see if you qualify.

Remember, finding the right full coverage car insurance policy is a balancing act. You need to find a policy that offers adequate coverage at a price you can afford. Don’t be afraid to shop around and compare quotes from multiple providers to ensure you’re getting the best value for your money.

Additional Considerations for Full Coverage

Choosing full coverage car insurance can offer peace of mind, but it’s crucial to understand the nuances that come with it. This includes recognizing the role of deductibles, exploring ways to lower your costs, and comprehending the significance of your policy’s terms and conditions.

Deductibles and Their Impact

Deductibles play a significant role in full coverage car insurance. They represent the amount you pay out-of-pocket before your insurance kicks in to cover the remaining costs of repairs or replacement. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

The relationship between deductibles and premiums is inversely proportional.

This means that as one increases, the other decreases. When deciding on your deductible, consider your risk tolerance and financial situation. If you’re comfortable covering a larger amount out-of-pocket in case of an accident, a higher deductible could save you money on your premiums.

Tips for Lowering Full Coverage Costs, What are full coverage car insurance quotes?

Several strategies can help you potentially lower your full coverage car insurance costs:

- Maintain a good driving record: Avoiding accidents and traffic violations demonstrates responsible driving habits, which can lead to lower premiums. Insurance companies often offer discounts for clean driving records.

- Consider bundling policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts. Insurance companies typically reward customers who choose multiple policies from them.

- Shop around for quotes: Comparing quotes from different insurance companies is essential to finding the best rates. Use online comparison tools or contact insurance companies directly to obtain quotes.

- Increase your deductible: As discussed earlier, raising your deductible can lower your premiums. This is a viable option if you’re comfortable covering a larger amount out-of-pocket in case of an accident.

- Take advantage of discounts: Many insurance companies offer discounts for various factors, such as good grades, safety features in your car, and safe driving courses. Inquire about available discounts and see if you qualify.

- Pay your premium in full: Some insurance companies offer discounts for paying your premium in full upfront instead of making monthly payments.

Understanding Policy Terms and Conditions

It’s crucial to thoroughly understand the terms and conditions of your full coverage car insurance policy. This includes:

- Coverage limits: Your policy’s coverage limits define the maximum amount your insurance company will pay for specific types of claims. It’s essential to ensure your coverage limits are adequate for your needs.

- Exclusions: Every policy has exclusions, which are specific events or situations that are not covered by your insurance. Familiarize yourself with these exclusions to avoid any surprises.

- Renewal process: Understand how your policy is renewed and what factors can influence your premium at renewal time. This can include your driving record, claims history, and changes in your vehicle.

Ultimate Conclusion

So, as you navigate the world of car insurance, remember that full coverage is more than just a policy; it’s a shield against life’s uncertainties. By understanding the factors that influence quotes, comparing options, and making informed decisions, you can find the full coverage policy that fits your needs and budget, providing you with the peace of mind you deserve.

FAQs

What’s the difference between full coverage and liability insurance?

Liability insurance covers damage you cause to other people or their property. Full coverage goes beyond that, adding protection for your own vehicle against things like collisions, theft, and natural disasters.

Is full coverage insurance always necessary?

While full coverage offers comprehensive protection, it might not be necessary for everyone. If you have an older car with a low value, you might opt for liability coverage instead. It’s best to weigh your individual circumstances and budget.

How often should I get new car insurance quotes?

It’s a good idea to shop around for new car insurance quotes at least once a year, or even more frequently if your driving record changes or you make significant life changes, like moving to a new city.