What are the best car insurance quotes for new drivers? This question is a common one, as new drivers often face higher insurance premiums due to their lack of experience. The good news is that there are ways to find affordable car insurance, even if you’re just starting out.

Insurance companies take a lot of factors into account when determining your rates, including your age, driving history, the type of car you drive, and where you live. Understanding these factors can help you navigate the insurance landscape and make informed decisions.

Understanding New Driver Insurance Costs

New drivers face a unique challenge when it comes to car insurance. They often find themselves paying significantly higher premiums than experienced drivers. This is due to a number of factors that insurance companies consider when assessing risk.

Factors Contributing to Higher Insurance Premiums for New Drivers

Insurance companies consider new drivers to be higher risk due to their lack of experience behind the wheel. This translates into higher premiums. Here’s a breakdown of the key factors:

- Lack of Driving Experience:New drivers have limited experience handling various driving situations, making them more prone to accidents.

- Higher Risk of Accidents:Statistics consistently show that new drivers are involved in more accidents than experienced drivers.

- Inexperience in Handling Emergencies:New drivers may struggle to react appropriately in emergencies, increasing the likelihood of accidents.

- Limited Driving Record:Insurance companies rely on driving records to assess risk. New drivers have limited or no records, making it difficult to assess their driving behavior.

Typical Insurance Costs for New Drivers vs. Experienced Drivers

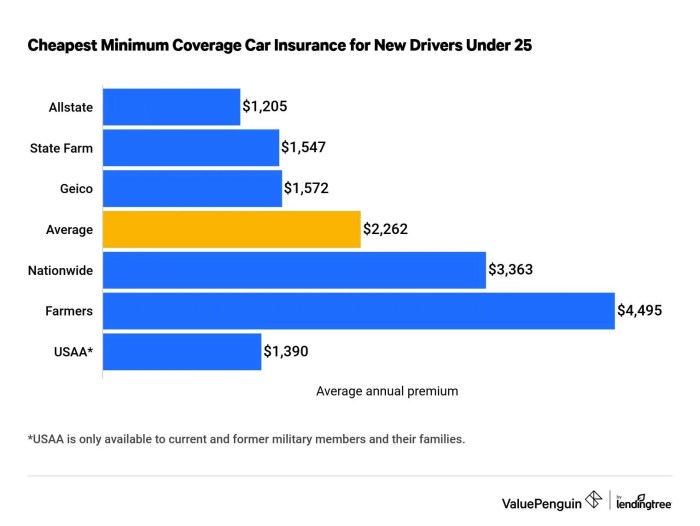

The cost of car insurance for new drivers is significantly higher than for experienced drivers. Here’s a general comparison:

- New Drivers:Expect to pay anywhere from 2 to 3 timesmore than experienced drivers for similar coverage.

- Experienced Drivers:Those with a clean driving record and several years of experience can enjoy lower premiums due to their proven safe driving habits.

Impact of Driving History, Age, and Vehicle Type on Insurance Rates

Several factors can influence insurance rates for new drivers, including driving history, age, and the type of vehicle.

- Driving History:A clean driving record with no accidents or traffic violations can significantly reduce insurance costs. Even a single incident can increase premiums considerably.

- Age:Younger drivers generally pay higher premiums due to their higher risk profile. As drivers gain experience and age, their premiums tend to decrease.

- Vehicle Type:The type of vehicle you drive also impacts insurance costs. High-performance cars or expensive luxury vehicles are often more expensive to insure due to their higher repair costs and potential for higher risk.

Essential Factors for Finding the Best Quotes

Getting the best car insurance quote as a new driver requires careful consideration of several key factors. Understanding these factors empowers you to make informed decisions and secure the most competitive rates.

Comparing Quotes from Multiple Insurers

It’s crucial to compare quotes from multiple insurers to find the best deal. Each insurer has its own pricing structure and risk assessment methods, leading to varying rates. By obtaining quotes from at least three to five insurers, you can identify the most competitive offers and choose the one that best suits your needs and budget.

Discounts and Coverage Options

Discounts play a significant role in lowering your insurance premiums. Explore the available discounts offered by insurers, such as:

- Good Student Discount:This discount is often available to students maintaining a good academic record.

- Safe Driver Discount:Insurers reward drivers with a clean driving history by offering a discount.

- Multi-Car Discount:If you insure multiple vehicles with the same insurer, you may qualify for a discount.

- Bundling Discount:Combining your car insurance with other policies, such as home or renters insurance, can lead to substantial savings.

Additionally, carefully consider your coverage options. While comprehensive and collision coverage provide financial protection in case of accidents, they can also increase your premiums. Assess your risk tolerance and financial situation to determine the most appropriate level of coverage.

Exploring Insurance Options for New Drivers

Navigating the world of car insurance as a new driver can feel overwhelming, with a plethora of options and jargon to decipher. Understanding the different types of coverage available is crucial to making informed decisions that protect you financially while driving.

This section will break down common insurance policies and explain their benefits, helping you choose the right coverage for your needs and budget.

Understanding Different Types of Coverage

New drivers are typically required to carry at least liability insurance, which protects you against financial losses incurred due to accidents you cause. However, additional coverage options can provide comprehensive protection and peace of mind. Let’s delve into the most common types of car insurance policies:

- Liability Insurance: This fundamental coverage is mandatory in most states and safeguards you from financial responsibility if you cause an accident, covering the other party’s medical bills, property damage, and legal expenses. It’s typically divided into two components:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries to the other driver and passengers in the other vehicle.

- Property Damage Liability: Covers damage to the other vehicle, property, or infrastructure involved in the accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It’s optional but highly recommended for new drivers, as accidents are more likely.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, natural disasters, and falling objects. It’s often bundled with collision coverage and offers peace of mind against unforeseen circumstances.

Deductibles and Coverage Limits

Deductibles and coverage limits are crucial factors that influence your insurance premium. Understanding their impact is essential for making informed decisions about your coverage.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, while a lower deductible leads to higher premiums. For example, if you choose a $500 deductible for collision coverage, you’ll pay the first $500 of repair costs, and your insurance will cover the remaining amount.

- Coverage Limits: These define the maximum amount your insurance company will pay for a specific type of claim. For instance, a liability coverage limit of $100,000 per person and $300,000 per accident means your insurance will cover up to $100,000 in medical expenses for one person involved in the accident and up to $300,000 for all injuries in the accident.

Higher coverage limits usually result in higher premiums.

Tips for Lowering Insurance Costs

As a new driver, you might feel overwhelmed by the high cost of car insurance. But don’t worry! There are several strategies you can employ to significantly reduce your premiums.

Defensive Driving Courses

Taking a defensive driving course can be a great way to lower your insurance costs. These courses teach you valuable driving skills and safe driving practices, demonstrating your commitment to responsible driving. Many insurance companies offer discounts to drivers who complete such courses.

Maintaining a Good Driving Record

A clean driving record is crucial for securing lower insurance premiums. Avoid any traffic violations, accidents, or driving under the influence. A good driving record reflects your responsible driving habits, which insurance companies value.

Car Safety Features

Modern cars come equipped with a range of safety features that can impact your insurance rates. Features like anti-lock brakes (ABS), electronic stability control (ESC), and airbags significantly reduce the risk of accidents and injuries. These features demonstrate your commitment to safety, leading to lower premiums.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as car insurance, homeowners insurance, or renters insurance. By combining your insurance needs with one provider, you can often negotiate lower rates.

Resources for New Drivers

Navigating the world of car insurance as a new driver can feel overwhelming. Fortunately, there are numerous resources available to help you understand your options and make informed decisions. From online platforms to dedicated organizations, you can find support and guidance throughout your insurance journey.

Reputable Online Resources, What are the best car insurance quotes for new drivers?

The internet offers a wealth of information for new drivers seeking car insurance. Here are some reputable online resources that can provide valuable insights and support:

- Insurance Information Institute (III):The III is a non-profit organization dedicated to educating the public about insurance. Their website offers comprehensive information on car insurance, including policy types, coverage options, and tips for finding the best rates. You can find valuable resources, such as articles, infographics, and videos, that explain complex insurance concepts in an easy-to-understand way.

- National Association of Insurance Commissioners (NAIC):The NAIC is a regulatory body that oversees the insurance industry. Their website provides information on insurance regulations, consumer protection, and state-specific insurance laws. This resource can be particularly helpful for understanding your rights as a consumer and navigating any potential disputes with your insurance company.

Finding the best car insurance quotes for new drivers can be a real head-scratcher, but remember, it’s all about finding the right coverage for your needs. And just like you’d want to ensure you have the right coverage for your car, you might also want to consider a Convertible Life Insurance Policy for your own peace of mind.

Once you’ve got the right car insurance, you can hit the road with confidence, knowing you’re protected.

- Consumer Reports:Consumer Reports is a well-respected organization that provides unbiased reviews and ratings of various products and services, including car insurance companies. Their website offers detailed information on insurance company performance, customer satisfaction, and financial stability. This can be a valuable tool for comparing different insurance providers and making informed decisions based on objective data.

Finding Trusted Insurance Agents and Brokers

Working with a knowledgeable and experienced insurance agent or broker can significantly simplify the process of finding the right car insurance policy. Here are some tips for finding a trusted professional:

- Seek Recommendations:Ask friends, family, and colleagues for recommendations on insurance agents or brokers they have had positive experiences with. Word-of-mouth referrals can be a reliable way to find trustworthy professionals.

- Check Credentials and Experience:Ensure that any agent or broker you consider is licensed and has adequate experience in the insurance industry. You can verify their credentials with your state’s insurance department.

- Look for Specializations:Some agents or brokers specialize in specific types of insurance, such as car insurance for young drivers. Choosing a professional with relevant expertise can ensure that you receive personalized advice and tailored solutions.

Navigating the Insurance Claims Process

Understanding how to file an insurance claim and navigate the claims process is essential for new drivers. Here are some key points to remember:

- Report the Accident Promptly:Contact your insurance company as soon as possible after an accident to report the incident. Provide all necessary details, including the date, time, location, and involved parties.

- Document the Accident:Take photographs or videos of the accident scene, including any damage to your vehicle and the other vehicles involved. Gather contact information from all parties involved, including witnesses.

- Follow Your Insurance Company’s Instructions:Your insurance company will provide specific instructions on how to proceed with the claim. Be sure to follow their guidelines carefully to ensure a smooth and efficient process.

Final Conclusion: What Are The Best Car Insurance Quotes For New Drivers?

Finding the best car insurance quotes as a new driver might seem like a daunting task, but it doesn’t have to be! By understanding the factors that influence your rates, comparing quotes from multiple insurers, and taking advantage of discounts, you can secure affordable coverage that fits your needs.

Remember, driving safely and maintaining a good driving record are the best ways to keep your premiums low in the long run.

Helpful Answers

How can I get a discount on my car insurance as a new driver?

Many insurance companies offer discounts for new drivers who take a defensive driving course, maintain good grades, or bundle their insurance policies.

What are some tips for finding a good insurance agent?

Look for an agent who is licensed and experienced, and who has a good reputation in your community. You can also ask friends and family for recommendations.

What should I do if I get into an accident?

If you’re involved in an accident, stay calm and call the police. Then, contact your insurance company to report the accident and begin the claims process.