What are the cheapest car insurance quotes? This question is on the minds of many drivers, especially those looking to save money on their monthly premiums. Car insurance is a necessity, but it doesn’t have to break the bank.

Understanding the factors that influence your quote, from your driving history to the type of car you drive, can make a big difference in securing the best price.

This guide will walk you through the process of finding the cheapest car insurance quotes, empowering you to make informed decisions and potentially save a significant amount of money. We’ll explore various strategies, from comparing quotes from different providers to understanding the impact of your driving record and vehicle type.

Get ready to unlock the secrets of affordable car insurance!

Understanding Car Insurance Quotes

Car insurance quotes are estimates of how much you’ll pay for coverage. They’re essential for comparing different insurance policies and finding the best deal. Understanding how these quotes are calculated is crucial for making informed decisions.

Factors Influencing Car Insurance Quotes

Car insurance quotes are based on a variety of factors that assess your risk as a driver. These factors can be categorized into three main groups:

- Driver-Related Factors:Your driving history, age, gender, marital status, and credit score are all considered. For instance, drivers with a clean record and good credit history tend to receive lower premiums.

- Vehicle-Related Factors:The make, model, year, and safety features of your car play a significant role in determining your insurance cost. Vehicles with higher safety ratings and anti-theft features often result in lower premiums.

- Location-Related Factors:Your location, including the state and zip code, can impact your insurance cost due to variations in accident rates and traffic congestion.

Types of Car Insurance Coverage, What are the cheapest car insurance quotes?

Car insurance policies offer various types of coverage to protect you and your vehicle in different situations. Understanding these coverages helps you choose the right level of protection.

- Liability Coverage:This coverage protects you financially if you’re at fault in an accident that causes damage to another person’s property or injuries. It’s typically required by law and covers medical expenses, property damage, and legal defense costs.

- Collision Coverage:This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. You can choose to waive this coverage for older vehicles, as the cost of repairs might exceed the vehicle’s value.

- Comprehensive Coverage:This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. You can also choose to waive this coverage for older vehicles.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP):This coverage, also known as No-Fault coverage, pays for your medical expenses and lost wages, regardless of fault, if you’re injured in an accident. It’s often required in certain states.

Tips for Obtaining Accurate Car Insurance Quotes

To get the most accurate and competitive car insurance quotes, consider these tips:

- Shop around:Get quotes from multiple insurance companies to compare rates and coverage options. You can use online comparison tools or contact insurers directly.

- Provide accurate information:Be honest and thorough when providing your personal and vehicle details to ensure you receive an accurate quote.

- Consider discounts:Many insurance companies offer discounts for safe driving, good student records, multi-car policies, and other factors. Ask about available discounts and ensure you qualify for them.

- Review your coverage:Periodically review your insurance policy to ensure it still meets your needs and that you’re not paying for unnecessary coverage.

Finding the Cheapest Quotes

Finding the cheapest car insurance quotes is a crucial step in ensuring you get the best value for your money. By comparing quotes from different providers, you can identify the most affordable options that meet your specific needs.

Comparing Car Insurance Providers

It’s essential to compare different car insurance providers to find the best rates. Here are some key factors to consider:

- Coverage options:Different providers offer various coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s essential to understand the different types of coverage and their importance in determining the right level of protection for you.

- Discounts:Many providers offer discounts for various factors, including safe driving records, good credit scores, multiple vehicle insurance, and bundling with other insurance products. It’s worthwhile to inquire about available discounts to potentially lower your premium.

- Customer service:Look for providers known for their excellent customer service, including prompt response times, helpful agents, and easy claims processes. This is crucial, especially if you ever need to file a claim.

- Financial stability:It’s essential to choose a financially stable insurance provider. You can check the provider’s ratings from organizations like AM Best or Standard & Poor’s to assess their financial strength.

Getting Quotes from Multiple Providers

To find the best car insurance rates, follow these steps:

- Gather your information:Before you start getting quotes, gather all the necessary information, including your driving history, vehicle information, and desired coverage levels. This will help you provide accurate information to each provider.

- Use online comparison tools:Online comparison tools allow you to quickly and easily compare quotes from multiple providers. These tools typically require you to enter your information once, and they will automatically generate quotes from various companies. Some popular comparison websites include:

- NerdWallet:NerdWallet provides comprehensive car insurance comparisons and insights, helping you find the best deals based on your specific needs.

- Insurance.com:Insurance.com offers a user-friendly platform for comparing quotes from multiple insurers. It also provides valuable resources and information about car insurance.

- Bankrate:Bankrate is a well-known financial website that also offers car insurance comparisons, allowing you to explore different options and find competitive rates.

- Contact individual providers:After using online comparison tools, consider contacting individual providers directly. This allows you to discuss your specific needs and ask questions about their policies and coverage options.

- Review and compare quotes:Once you have received quotes from multiple providers, carefully review them and compare the coverage, premiums, and other terms. Look for any hidden fees or limitations in the policies.

Benefits of Using Online Comparison Tools

Online comparison tools offer several benefits:

- Convenience:Online comparison tools save you time and effort by allowing you to compare quotes from multiple providers in one place.

- Objectivity:Comparison tools present quotes from different providers side-by-side, enabling you to make objective comparisons based on price, coverage, and other factors.

- Transparency:Online comparison tools typically provide clear and concise information about each provider’s policies, making it easier to understand the differences and choose the right option for you.

Factors Affecting Quote Prices

Insurance companies use a complex system to calculate car insurance premiums. Many factors influence your quote, and understanding them can help you find the best rates.

Driving History

Your driving history is one of the most significant factors affecting your car insurance premiums. Insurance companies consider your driving record, including accidents, traffic violations, and even your age.

- Accidents:A recent accident, especially one where you were at fault, will likely lead to higher premiums. The severity of the accident and the number of accidents you’ve had also play a role. Insurance companies consider you a higher risk if you’ve been involved in multiple accidents.

- Traffic Violations:Traffic violations like speeding tickets, reckless driving, or driving under the influence can significantly increase your premiums. These violations indicate a higher risk of future accidents.

- Age and Experience:Young drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk is reflected in higher premiums. As you gain experience and a clean driving record, your premiums will typically decrease.

Vehicle Type and Age

The type and age of your vehicle also play a significant role in determining your insurance premiums. Insurance companies consider the cost of repairs, the risk of theft, and the likelihood of accidents.

- Vehicle Type:Sports cars and luxury vehicles are generally more expensive to repair and insure than sedans or hatchbacks. They are also more likely to be stolen.

- Vehicle Age:Newer vehicles are typically more expensive to repair, but they may also have more safety features, which can lower premiums. Older vehicles may have a higher risk of breakdowns and accidents, leading to higher premiums.

Location and Coverage Levels

Where you live and the level of coverage you choose also affect your insurance premiums.

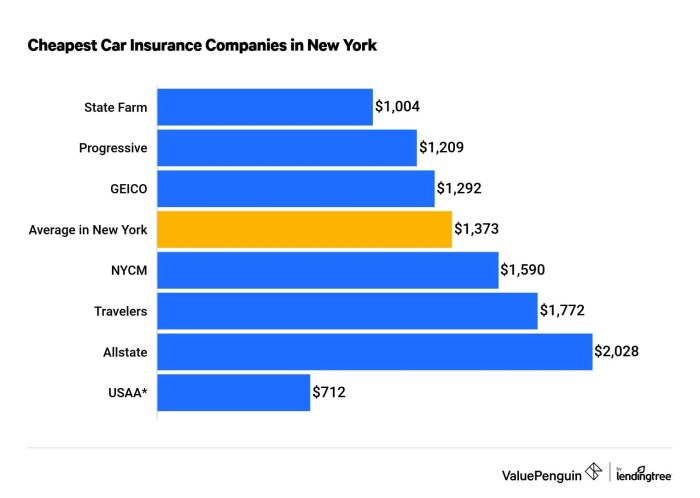

- Location:Insurance rates vary by location due to factors like traffic density, crime rates, and the cost of repairs in different areas. For example, cities with higher traffic congestion and crime rates may have higher insurance premiums.

- Coverage Levels:Higher coverage levels, such as comprehensive and collision coverage, will generally lead to higher premiums. However, these coverages provide greater financial protection in case of accidents or theft.

Saving on Car Insurance

You’ve worked hard to find the cheapest car insurance quotes, but that’s just the first step. Now, it’s time to get creative and save even more on your premiums. Think of it like a treasure hunt, where you can uncover hidden discounts and negotiate your way to a lower price.

It’s all about understanding the factors that affect your insurance costs and using them to your advantage.

Common Discounts

Knowing about available discounts is crucial to maximizing your savings. Here’s a table outlining common discounts and their eligibility criteria:| Discount Type | Eligibility Criteria ||—|—|| Good Driver Discount | Clean driving record with no accidents or violations || Safe Driver Course Discount | Completion of a certified defensive driving course || Multi-Car Discount | Insuring multiple vehicles with the same insurer || Multi-Policy Discount | Bundling car insurance with other policies like home or renters insurance || Good Student Discount | Maintaining a high GPA for students under 25 || Anti-theft Device Discount | Installing approved anti-theft devices like alarms or tracking systems || Payment in Full Discount | Paying your annual premium in one lump sum || Loyalty Discount | Maintaining continuous coverage with the same insurer for a specified period |

Negotiating with Insurance Providers

Don’t be afraid to negotiate with insurance providers. They’re often willing to work with you, especially if you’re a loyal customer or have a clean driving record. Here are some tips for negotiating:

“Don’t be afraid to ask for a better rate. Insurance companies are often willing to negotiate, especially if you’re a good customer.”

Research competitor rates

Compare quotes from multiple insurers to see what others are offering.

Highlight your good driving record

Emphasize your clean driving history and lack of accidents or violations.

Ask about bundled discounts

Inquire about discounts for bundling multiple policies with the same insurer.

Finding the cheapest car insurance quotes can feel like searching for a needle in a haystack! But don’t worry, it doesn’t have to be a stressful ordeal. You can easily compare quotes from different insurers by simply checking out how to get a car insurance quote online.

Once you’ve got those quotes, you can compare the prices and find the best deal for your needs, making sure you’re not overpaying for your car insurance.

Consider increasing your deductible

A higher deductible can lead to lower premiums.

Be polite and persistent

Don’t be afraid to ask for a better rate, but remain respectful and polite.

Understanding Your Policy

Your car insurance policy is a legally binding contract between you and your insurance company. It Artikels the terms and conditions of your coverage, including what is covered, how much you will pay, and what you need to do in case of an accident.

Understanding your policy is crucial to ensure you are adequately protected and know how to navigate the claims process.

Reviewing Policy Terms and Conditions

It is essential to thoroughly read and understand your policy terms and conditions. This document will Artikel the specific details of your coverage, including the types of accidents and incidents covered, the limits of your coverage, and any exclusions. It also Artikels your responsibilities as the policyholder, such as reporting accidents promptly and cooperating with the insurance company during the claims process.

For example, you may find that your policy covers collision damage but excludes comprehensive coverage for events like theft or vandalism.

Filing a Claim and Understanding Coverage Limits

In the event of an accident or incident covered by your policy, you must file a claim with your insurance company. This process typically involves contacting your insurer, providing details about the incident, and completing necessary paperwork. Understanding your coverage limits is crucial when filing a claim.

- Deductible: The deductible is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. For example, if your deductible is $500 and you have $2,000 in damages, you would pay the first $500, and your insurance company would cover the remaining $1,500.

- Coverage Limits: Your policy will also specify coverage limits, which represent the maximum amount your insurance company will pay for a particular type of claim. For example, your liability coverage may have a limit of $100,000 per accident. This means your insurance company will pay up to $100,000 for injuries or property damage caused to others in an accident.

Conclusion: What Are The Cheapest Car Insurance Quotes?

In conclusion, finding the cheapest car insurance quotes is a journey that requires research, comparison, and a bit of savvy negotiation. By understanding the factors that affect your premiums, comparing quotes from multiple providers, and exploring potential discounts, you can secure the best possible rate.

Remember, it’s not just about the lowest price; it’s about finding the right coverage at a price that fits your budget. So, get out there, explore your options, and drive confidently knowing you’ve secured the best deal possible!

General Inquiries

What is a car insurance quote?

A car insurance quote is an estimate of how much an insurance company would charge you for coverage based on your specific information, such as your driving history, vehicle details, and desired coverage levels.

How often should I get car insurance quotes?

It’s a good idea to get car insurance quotes at least once a year, especially when your policy is up for renewal. You might find better rates from different companies or even with your current insurer.

What if I’m a new driver?

New drivers often face higher insurance premiums due to their lack of experience. However, you can still find affordable rates by shopping around, comparing quotes, and considering discounts for good grades or safe driving courses.