Flood insurance quotes – they might sound like a dry topic, but they’re actually a lifeline for homeowners in flood-prone areas. Imagine this: you’ve poured your heart and soul into your home, only to have it ravaged by a flood.

Flood insurance can be your shield, protecting your investment and giving you peace of mind. But navigating the world of flood insurance quotes can feel like wading through a murky river. That’s where we come in – we’ll guide you through the process, helping you understand the factors that influence premiums, the different types of coverage, and how to get the best quote for your needs.

Think of flood insurance as a safety net, ready to catch you when unexpected storms roll in. We’ll help you understand the different types of coverage, the ins and outs of the National Flood Insurance Program (NFIP), and even how flood insurance can affect your home’s value and mortgage financing.

Ready to dive in?

Understanding Flood Insurance Coverage

Understanding the ins and outs of flood insurance coverage is crucial for anyone living in a flood-prone area. This guide will provide you with a comprehensive understanding of what is covered, what is excluded, and how claims are processed.

Navigating the world of insurance can feel like wading through a flood, right? But just like you’d want to be prepared for a flood with flood insurance quotes, it’s equally important to have the right coverage for your car.

Check out auto insurance quotes to make sure you’re protected against the unexpected. After all, a little planning now can save you a lot of headaches (and potential financial burdens) down the road. So, whether it’s your home or your car, getting those quotes is a smart move.

Types of Flood Damage Covered

Flood insurance policies cover a wide range of damages caused by floodwaters. These damages can include:

- Building damage:This covers structural damage to the building itself, such as damage to walls, floors, ceilings, and foundations.

- Personal property damage:This covers damage to your belongings, such as furniture, appliances, clothing, and electronics.

- Debris removal:Flood insurance covers the cost of removing debris from your property after a flood.

- Living expenses:If your home is uninhabitable due to flooding, flood insurance can cover the cost of temporary housing and other living expenses.

Exclusions and Limitations

While flood insurance provides comprehensive coverage for flood-related damages, there are certain exclusions and limitations you should be aware of:

- Pre-flood damage:Flood insurance does not cover damage that existed before the flood event.

- Ground cover:Coverage for damage to landscaping, lawns, and trees is typically limited.

- Basement exclusions:Basements are often subject to exclusions or limitations, especially for finished basements.

- Flood insurance premiums:The premium for flood insurance is based on the flood risk of your property. Properties in high-risk areas will typically have higher premiums.

- Deductibles:You will have to pay a deductible before your flood insurance coverage kicks in. Deductibles can range from $500 to $10,000, depending on your policy.

Filing a Flood Insurance Claim

When filing a flood insurance claim, it’s important to take the following steps:

- Contact your insurance company immediately:Report the flood damage to your insurance company as soon as possible.

- Document the damage:Take photographs and videos of the flood damage to your property.

- Keep receipts:Keep receipts for any expenses incurred as a result of the flood, such as temporary housing or repairs.

- Cooperate with your insurance company:Provide your insurance company with all the information they need to process your claim.

Factors Affecting Claim Payouts

Several factors can affect the amount of your flood insurance claim payout. These include:

- The extent of the damage:The more extensive the damage, the higher the claim payout will be.

- The value of your property:The value of your property will also affect the claim payout. Properties with a higher value will typically receive larger payouts.

- Your policy limits:Your flood insurance policy has limits on the amount of coverage you have. You will not be able to receive more than your policy limit in a claim payout.

- Deductible:You will have to pay your deductible before you receive any claim payout.

Flood Risk Assessment and Mitigation

Knowing your property’s flood risk is crucial. It helps you make informed decisions about your home, potentially saving you from significant financial losses and heartache.

Understanding Flood Risk

Understanding your property’s flood risk is the first step in protecting yourself and your investments. This involves assessing the likelihood of flooding in your area and the potential severity of such events.

Resources for Assessing Flood Risk

Several resources are available to help property owners understand their flood risk.

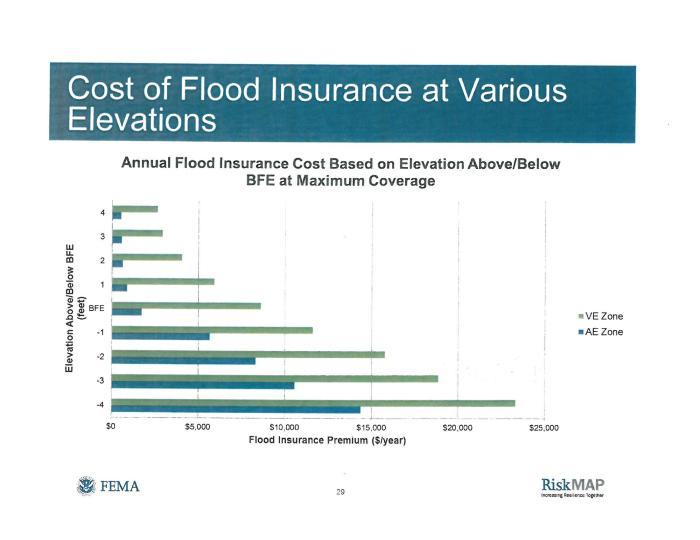

- Flood Maps:The Federal Emergency Management Agency (FEMA) provides flood maps that depict areas with varying flood risks. These maps are crucial for understanding the potential impact of flooding in your area.

- Risk Assessment Tools:Online tools and resources, often provided by insurance companies or government agencies, can help you assess your specific property’s flood risk. These tools typically factor in factors like elevation, proximity to water bodies, and historical flood data.

Flood Mitigation Measures, Flood insurance quotes

Once you understand your flood risk, you can take steps to mitigate it. Flood mitigation measures aim to reduce the impact of flooding on your property and can potentially lower your insurance premiums.

- Elevating Building:Elevating your home or other structures above the base flood elevation can significantly reduce flood damage. This involves raising the foundation or using stilts to create a higher floor level.

- Floodproofing:Floodproofing involves making your property more resistant to flood damage. This can include sealing basement walls, installing waterproof doors and windows, and using flood-resistant materials for construction.

- Drainage Improvements:Improving drainage around your property can help redirect floodwaters away from your home. This might involve installing gutters, downspouts, and drainage systems to channel water away from your foundation.

- Landscaping:Strategically landscaping your property can help manage floodwaters. For example, planting trees and shrubs can help slow down runoff and absorb water, reducing the risk of flooding.

Flood Insurance Regulations and Policies

Navigating the complex world of flood insurance requires understanding the regulations and policies that govern it. This section delves into the federal and state regulations that shape flood insurance, the National Flood Insurance Program (NFIP) and its crucial role, and the different types of flood insurance policies available.

Federal and State Regulations

Federal and state regulations play a vital role in ensuring the availability and affordability of flood insurance. The primary federal legislation governing flood insurance is the National Flood Insurance Act of 1968, which established the NFIP. This program is administered by the Federal Emergency Management Agency (FEMA) and provides flood insurance to homeowners, renters, and businesses in participating communities.

State regulations also influence flood insurance. Many states have their own flood insurance requirements, which can vary depending on the state’s risk profile and existing regulations. These regulations might include:

- Floodplain Management Ordinances:These ordinances regulate development in flood-prone areas to minimize flood risk and damage.

- Flood Insurance Requirements:Some states mandate flood insurance for properties located in high-risk flood zones.

- Flood Insurance Rate Maps (FIRMs):States may adopt or modify FEMA’s FIRMs to reflect their specific flood risks.

National Flood Insurance Program (NFIP)

The NFIP is a federal program that provides flood insurance to property owners in participating communities. It is a critical component of the nation’s flood risk management strategy. The NFIP’s role extends beyond providing insurance; it also encourages communities to adopt and enforce floodplain management regulations.

This approach aims to reduce future flood damage and minimize the financial burden on the program.

Types of Flood Insurance Policies

The NFIP offers two primary types of flood insurance policies:

- Standard Flood Insurance Policy (SFIP):The SFIP is the most common type of flood insurance policy available through the NFIP. It provides coverage for buildings and their contents against direct physical loss caused by flooding.

- Emergency Flood Insurance Policy:This policy is available in areas that have been declared disaster areas due to flooding. It provides temporary coverage for properties that are not eligible for the SFIP.

In addition to the NFIP, private insurers also offer flood insurance policies. These policies can provide more comprehensive coverage than the SFIP but may also have higher premiums.

Flood Insurance and Homeownership

Flood insurance plays a crucial role in homeownership decisions, impacting both financial stability and peace of mind. It provides financial protection against the devastating consequences of floods, a risk that is often overlooked but can have significant financial implications. Understanding how flood insurance interacts with homeownership is essential for making informed decisions.

Impact of Flood Insurance on Homeownership Decisions

Flood insurance can significantly influence the decision to purchase a property, especially in areas prone to flooding. It is a critical factor to consider, alongside other aspects such as property value, mortgage financing, and personal risk tolerance.

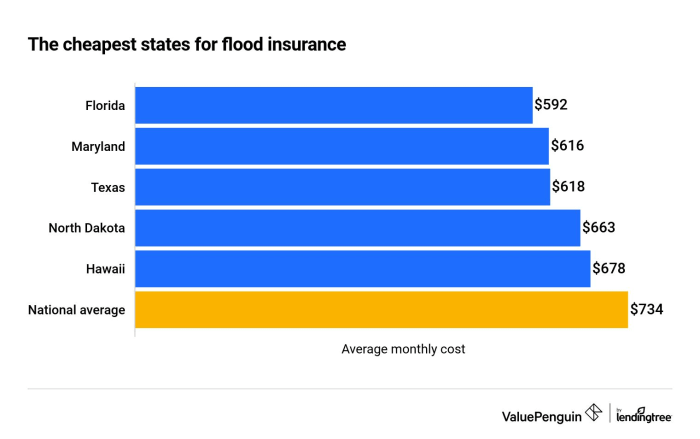

- Increased Costs:Flood insurance premiums can add a substantial recurring expense to the cost of homeownership. The premium amount varies based on factors like property location, flood risk, and the level of coverage selected.

- Financial Security:Flood insurance provides financial protection against potential flood damage, which can be extremely costly to repair or rebuild. It mitigates the risk of substantial financial loss, allowing homeowners to recover from flood events and rebuild their lives.

- Mortgage Requirements:In many cases, mortgage lenders require flood insurance for properties located in high-risk flood zones. This requirement ensures that the lender’s investment is protected in case of a flood event.

- Property Value:The availability of flood insurance can influence property value. Homes in areas with readily available flood insurance may be more attractive to potential buyers, as it reduces the risk associated with flood damage.

Finding Flood Insurance Coverage

Finding the right flood insurance coverage requires careful consideration of individual needs and circumstances. It is essential to explore different insurance options and compare premiums, coverage levels, and policy terms.

- Assess Flood Risk:Start by understanding the flood risk associated with your property. Factors like location, proximity to water bodies, and historical flood events can influence your flood risk.

- Compare Insurance Providers:Obtain quotes from multiple insurance providers to compare premiums and coverage options. Look for providers with a strong reputation and a history of handling flood claims efficiently.

- Consider Coverage Levels:Flood insurance policies offer different coverage levels. Choose a level that adequately protects your property value and belongings against potential flood damage.

- Review Policy Terms:Carefully read and understand the policy terms, including deductibles, coverage limits, and exclusions. This ensures you are aware of the policy’s scope and limitations.

Impact of Flood Insurance on Property Values and Mortgage Financing

Flood insurance can influence property values and mortgage financing decisions. Its presence can enhance the attractiveness of a property to potential buyers, while its absence can deter buyers or increase financing costs.

- Property Value Enhancement:The availability of flood insurance can increase a property’s value by mitigating the risk associated with flood damage. Buyers may be willing to pay a higher price for a property with flood insurance, knowing they are protected against potential financial losses.

- Mortgage Financing:Mortgage lenders often require flood insurance for properties located in high-risk flood zones. This requirement ensures that the lender’s investment is protected in case of a flood event. The absence of flood insurance may make it difficult to secure a mortgage or result in higher interest rates.

Final Review: Flood Insurance Quotes

Flood insurance might not be the most exciting topic, but it’s essential for protecting your biggest investment. Understanding the different types of policies, comparing quotes, and knowing what’s covered are crucial steps in ensuring you have the right protection.

By taking the time to research and understand your options, you can make informed decisions about your flood insurance needs and safeguard your home from the unexpected. So, take a deep breath, and let’s navigate this flood of information together!

Detailed FAQs

What is the difference between flood insurance and homeowners insurance?

Homeowners insurance typically doesn’t cover flood damage. Flood insurance is a separate policy specifically designed to protect your property from flooding.

Do I need flood insurance if I live in a high-risk area?

If you live in a high-risk flood zone, it’s highly recommended. Even if you’re not in a high-risk zone, consider the potential for unexpected flooding and weigh the benefits of having flood insurance.

How often should I review my flood insurance policy?

It’s a good idea to review your policy at least annually, especially if you’ve made any changes to your property or if your flood risk has changed.

What factors affect my flood insurance premium?

Your premium can be influenced by factors like your location, the value of your property, the flood risk in your area, and the amount of coverage you choose.