Pet insurance comparison is a vital step in ensuring your beloved companion receives the best possible care, especially considering the rising cost of veterinary services. It’s like shopping for health insurance for yourself, but with a wagging tail and a whole lot of cuddles involved!

Navigating the world of pet insurance can feel overwhelming, with countless providers offering various plans and coverage options. But fear not, this guide will equip you with the knowledge and tools to make informed decisions, ensuring your pet’s health and your peace of mind.

Pet Insurance: A Smart Choice for Your Furry Friend

In today’s world, our pets are more than just companions; they’re family. As responsible pet owners, we want to provide them with the best possible care, but the rising cost of veterinary services can be a major concern. This is where pet insurance comes in, offering a safety net for unexpected medical expenses and peace of mind for you and your furry friend.

The Growing Cost of Veterinary Care

Veterinary care costs have been steadily increasing for years. According to the American Veterinary Medical Association (AVMA), the average cost of a dog visit to a veterinarian in 2022 was $150, while the average cost of a cat visit was $120.

These costs can escalate quickly, especially in cases of emergencies or chronic conditions.

Here are some factors contributing to the rising cost of veterinary care:

- Advancements in veterinary medicine: New technologies and treatments, while beneficial for pets, can be expensive.

- Increased demand for specialized care: More pet owners are seeking specialized care, such as specialists in oncology, cardiology, or ophthalmology, which can be more costly.

- Inflation: Just like other industries, veterinary services are affected by inflation, leading to price increases.

Pet Insurance Plans and Their Benefits

Pet insurance plans are designed to help offset the financial burden of unexpected veterinary bills. They work by providing coverage for a range of medical expenses, including:

- Illness and injuries

- Surgeries

- Hospitalization

- Prescription medications

- Diagnostic tests

There are different types of pet insurance plans available, each with varying levels of coverage and costs. Here are some common benefits of pet insurance:

- Financial protection:Pet insurance can help cover the cost of unexpected medical bills, preventing financial strain.

- Peace of mind:Knowing you have insurance can alleviate stress and allow you to focus on your pet’s recovery without worrying about the cost.

- Access to specialized care:Insurance can make it easier to afford specialized treatments or procedures that might otherwise be out of reach.

- Potential for cost savings:While you pay premiums, the potential for significant savings on vet bills can outweigh the cost of insurance, especially in the event of a major illness or injury.

Key Factors to Consider

Choosing the right pet insurance plan can be a daunting task, as numerous factors come into play. Understanding these key considerations will help you make an informed decision and find the plan that best suits your furry friend’s needs and your budget.

Coverage Options

The scope of coverage offered by different pet insurance plans varies significantly. It’s crucial to understand the different types of coverage available and how they can impact your overall costs.

- Accident Coverage:This is the most common type of pet insurance, covering unexpected injuries like broken bones, cuts, and poisoning.

- Illness Coverage:This coverage extends to medical expenses related to illnesses such as infections, cancer, and chronic conditions.

- Preventative Care:Some plans include coverage for routine checkups, vaccinations, and dental care. While not always essential, preventative care can help catch potential health issues early and potentially reduce overall healthcare costs.

Pet’s Breed, Age, and Health History

The characteristics of your pet can significantly influence your insurance premium and coverage options.

- Breed:Certain breeds are prone to specific health issues, such as hip dysplasia in German Shepherds or heart problems in Cavalier King Charles Spaniels. Insurers may adjust premiums based on breed-specific risks.

- Age:Younger pets generally have lower premiums than older pets, as they are statistically less likely to require extensive medical care.

- Health History:Pre-existing conditions can impact coverage options and premiums. Some insurers may exclude coverage for conditions present before the policy’s start date.

Types of Pet Insurance Plans: Pet Insurance Comparison

Pet insurance plans offer different levels of coverage and pricing to cater to various pet owner needs and budgets. Understanding the types of plans available helps you make an informed decision that best suits your pet’s health needs and your financial situation.

Types of Pet Insurance Plans

Pet insurance plans are typically categorized based on the level of coverage they offer. Here’s a breakdown of common plan types, along with their key features:

| Plan Name | Coverage | Premium | Deductible | Co-insurance |

|---|---|---|---|---|

| Basic | Covers accidents and illnesses, often with limitations on specific conditions or treatments. | Lower than comprehensive plans. | Higher than comprehensive plans. | Higher than comprehensive plans. |

| Comprehensive | Covers accidents, illnesses, and sometimes wellness care, including routine checkups, vaccinations, and dental cleanings. | Higher than basic plans. | Lower than basic plans. | Lower than basic plans. |

| Accident-Only | Covers only accidents, such as injuries from falls, car accidents, or bites. | Lowest premium among all plan types. | Can vary depending on the plan. | Can vary depending on the plan. |

| Wellness | Focuses on preventive care, including routine checkups, vaccinations, and dental cleanings. | Can be added as a rider to other plans or purchased separately. | Not applicable. | Not applicable. |

Advantages and Disadvantages of Each Plan Type

- Basic Plans

- Advantages:Affordable, provides coverage for unexpected accidents and illnesses.

- Disadvantages:Limited coverage, higher deductibles and co-insurance, may exclude certain conditions or treatments.

- Comprehensive Plans

- Advantages:Comprehensive coverage for accidents, illnesses, and sometimes wellness care, lower deductibles and co-insurance.

- Disadvantages:Higher premiums, may have limitations on coverage for pre-existing conditions or certain treatments.

- Accident-Only Plans

- Advantages:Most affordable option, provides coverage for unexpected accidents.

- Disadvantages:Limited coverage, does not cover illnesses or preventive care.

- Wellness Plans

- Advantages:Covers routine preventive care, helps manage pet’s health proactively.

- Disadvantages:May not cover accidents or illnesses, may have limited coverage for specific procedures.

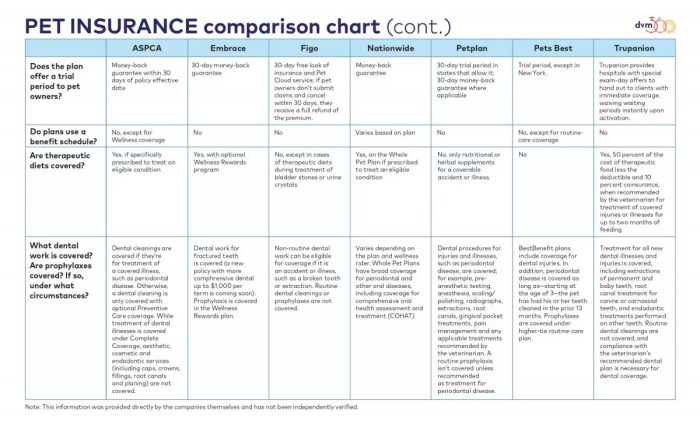

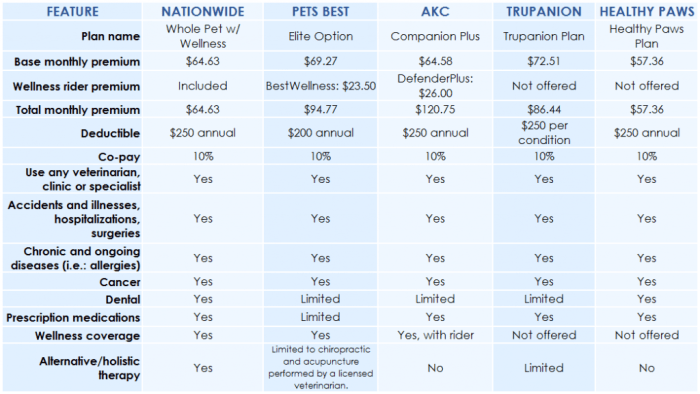

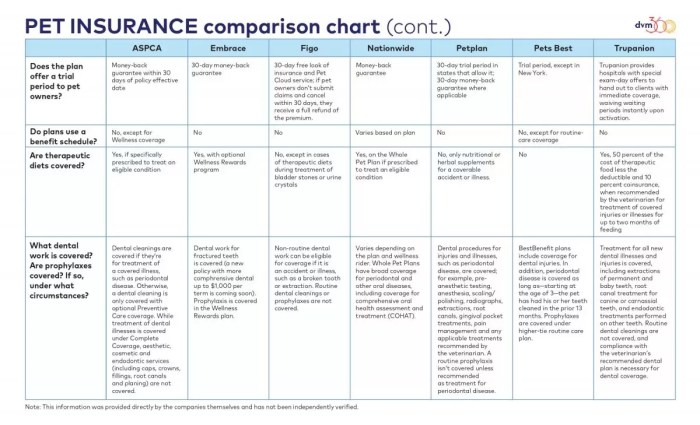

Top Pet Insurance Providers

Choosing the right pet insurance provider is crucial for ensuring comprehensive coverage and peace of mind. Numerous providers offer various plans and benefits, making it essential to compare them thoroughly. Here’s a detailed overview of some of the top providers in the market, along with their strengths and weaknesses.

Top Pet Insurance Providers

Here is a table comparing some of the top pet insurance providers in the market:

| Provider Name | Coverage Options | Pricing | Customer Reviews | Pros | Cons |

|---|---|---|---|---|---|

| Trupanion | Comprehensive coverage, including accidents, illnesses, and hereditary conditions. | Generally higher premiums but often covers more. | Mixed reviews, some praising their claims process, while others cite issues with customer service. |

|

|

| Embrace Pet Insurance | Offers a variety of plans, including accident-only and comprehensive coverage. | Competitive pricing with different plan options. | Generally positive reviews, with high praise for their customer service. |

|

|

| Healthy Paws Pet Insurance | Comprehensive coverage for accidents, illnesses, and some hereditary conditions. | Competitive pricing and transparent policies. | Highly rated for customer service and claims processing. |

|

|

| ASPCA Pet Insurance | Offers a variety of plans, including accident-only and comprehensive coverage. | Competitive pricing with discounts for multiple pets. | Generally positive reviews, with praise for their customer service and claims process. |

|

|

Getting a Quote and Choosing a Plan

Getting a pet insurance quote is usually a straightforward process. You’ll need to provide some basic information about your pet, including their breed, age, location, and any pre-existing conditions. You can then compare quotes from different providers to find the best deal.

Factors Affecting Pet Insurance Costs

Several factors influence the cost of pet insurance. Understanding these factors can help you make informed decisions about your coverage.

- Pet’s Breed and Age:Certain breeds are prone to specific health issues, which can increase insurance premiums. Younger pets generally have lower premiums than older pets, as they are statistically less likely to require extensive medical care.

- Location:The cost of veterinary care varies across different regions. Areas with higher veterinary costs tend to have higher pet insurance premiums.

- Coverage Level:Higher coverage levels, such as those covering more conditions or offering higher reimbursement limits, typically come with higher premiums.

- Deductible:The deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible usually results in lower premiums.

- Reimbursement Percentage:The reimbursement percentage determines how much your insurance will cover. A higher reimbursement percentage, like 80% or 90%, will result in higher premiums.

Choosing the Right Pet Insurance Plan

Choosing the right pet insurance plan requires careful consideration of your pet’s needs, your budget, and your risk tolerance.

- Consider your pet’s health history:If your pet has a history of health problems, you might want to opt for a plan with higher coverage levels and a lower deductible.

- Evaluate your budget:Pet insurance premiums can vary significantly, so it’s important to choose a plan that fits your budget. Consider the monthly premium and the potential costs you might incur if you need to use your insurance.

- Think about your risk tolerance:If you are comfortable taking on more risk, you might choose a plan with a higher deductible and lower premiums. However, if you prefer to be covered for a wider range of expenses, you might opt for a plan with a lower deductible and higher premiums.

- Read the fine print:Before signing up for a plan, carefully review the policy documents. Pay attention to the coverage details, exclusions, and waiting periods.

Claims Process and Exclusions

When you need to file a claim, understanding the process and potential limitations is crucial. The claims process for pet insurance generally involves submitting a claim form, providing supporting documentation, and waiting for a decision from the insurance company.

Common Exclusions and Limitations, Pet insurance comparison

Pet insurance policies often have exclusions and limitations that define what is not covered. It’s essential to carefully review these details before purchasing a policy.

- Pre-existing Conditions: Most pet insurance policies will not cover conditions that existed before the policy’s effective date. For example, if your dog has a history of hip dysplasia, it may not be covered under a new policy.

- Routine Care: Routine veterinary care, such as vaccinations, spaying/neutering, and annual checkups, are usually not covered by pet insurance.

- Breed-Specific Conditions: Some policies may exclude coverage for conditions common to certain breeds, such as hip dysplasia in German Shepherds or eye problems in Cavalier King Charles Spaniels.

- Behavioral Issues: Conditions related to behavioral problems, such as aggression or anxiety, are typically not covered.

- Cosmetic Procedures: Pet insurance usually does not cover elective or cosmetic procedures, such as tail docking or ear cropping.

- Dental Care: While some policies offer coverage for dental issues, many have limitations on the amount covered or exclude certain procedures.

- Injuries from Specific Activities: Policies may exclude coverage for injuries sustained during specific activities, such as dog fighting or racing.

Submitting Claims Successfully

To increase your chances of a successful claim, follow these tips:

- Keep Detailed Records: Maintain thorough records of your pet’s veterinary care, including dates, diagnoses, treatments, and costs. This will provide the necessary documentation for your claim.

- Submit Your Claim Promptly: Most pet insurance policies have time limits for submitting claims, typically within 30-60 days of the incident. Ensure you meet the deadline to avoid delays or claim denials.

- Provide All Required Information: Complete the claim form accurately and provide all requested documentation, such as veterinary bills, medical records, and treatment summaries.

- Communicate with Your Insurance Provider: If you have any questions or need clarification, contact your insurance provider directly. They can guide you through the claims process and provide assistance.

Alternatives to Pet Insurance

While pet insurance offers a safety net for unexpected veterinary bills, it’s not the only way to manage your pet’s healthcare costs. Several alternatives exist, each with its own advantages and disadvantages.

Pet Savings Accounts

Pet savings accounts are dedicated funds specifically for your pet’s healthcare. These accounts are similar to traditional savings accounts, allowing you to deposit and withdraw money as needed.

- Pros:You control the funds and can use them for any pet-related expenses, including preventative care, unexpected illnesses, and even grooming.

- Cons:You’ll need to consistently save to build up a sufficient balance. You’ll also be responsible for covering all costs upfront, potentially leading to financial strain in emergencies.

Emergency Funds

An emergency fund is a separate savings account set aside for unforeseen expenses, including pet healthcare. It serves as a safety net for unexpected situations like accidents, illnesses, or injuries.

- Pros:Provides a financial cushion for unexpected vet bills, offering peace of mind in emergency situations.

- Cons:Building up a substantial emergency fund can take time and consistent saving. You’ll need to ensure the fund is sufficient to cover potential high veterinary costs.

Wellness Plans

Wellness plans are pre-paid programs offered by veterinarians that cover routine preventive care, such as vaccinations, parasite prevention, and annual checkups.

- Pros:Offer significant savings on routine care, encouraging regular checkups and early detection of health issues. Some plans may also include discounts on certain services or medications.

- Cons:Limited coverage, typically only covering routine care and not unexpected illnesses or injuries. May not be suitable for pets with pre-existing conditions.

Conclusion

Navigating the world of pet insurance can feel overwhelming, but it doesn’t have to be. By taking the time to understand the key factors, comparing plans, and carefully choosing the right provider, you can make a smart and informed decision for your furry friend.

Key Takeaways

Pet insurance is a valuable tool for protecting your pet’s health and your wallet. By comparing plans and understanding the key factors, you can choose a policy that meets your pet’s needs and your budget.

Comparing pet insurance plans can feel like navigating a jungle of options, but it’s worth the effort to find the right coverage for your furry friend. Just like you might consider Long-term care insurance for yourself as you age, pet insurance can provide financial peace of mind for unexpected vet bills later in life.

So, roll up your sleeves, grab your trusty calculator, and get ready to compare those policies!

Conclusion

Remember, choosing the right pet insurance plan is a personal decision that should reflect your pet’s individual needs and your budget. By carefully considering factors like coverage options, provider reputation, and the claims process, you can confidently select a plan that provides the best protection for your furry friend.

After all, they deserve the best care, and a little peace of mind never hurts!

Detailed FAQs

What is the average cost of pet insurance?

The cost of pet insurance varies greatly depending on factors like your pet’s breed, age, location, and the coverage level you choose. It’s best to get quotes from several providers to compare prices.

Does pet insurance cover pre-existing conditions?

Generally, pet insurance policies do not cover pre-existing conditions. However, some providers may offer limited coverage for pre-existing conditions under specific circumstances.

How long does it take to get a claim processed?

The claim processing time can vary depending on the provider and the complexity of the claim. Most providers aim to process claims within a few weeks.