Short-term health insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with entertaining interactive style and brimming with originality from the outset. Short-term health insurance is a type of health insurance that provides coverage for a limited period, typically ranging from a few months to a year.

It’s designed to bridge gaps in coverage for individuals who are between traditional health insurance plans or who need temporary coverage for a specific reason, like a job change or a short-term project.

Think of it as a safety net for those times when you need a little extra protection without committing to a long-term plan. Short-term health insurance can offer peace of mind during those transition periods, helping you manage unexpected medical expenses without breaking the bank.

What is Short-Term Health Insurance?

Short-term health insurance is a type of health insurance plan that provides coverage for a limited period, typically ranging from 30 to 364 days. It’s designed to bridge the gap between health insurance plans or provide temporary coverage for individuals who are between jobs or waiting for other insurance to kick in.Short-term health insurance is a valuable option for individuals seeking affordable coverage for a limited time.

Key Features and Benefits

Short-term health insurance offers several key features and benefits, making it an attractive option for certain individuals. Here are some of the most notable aspects:

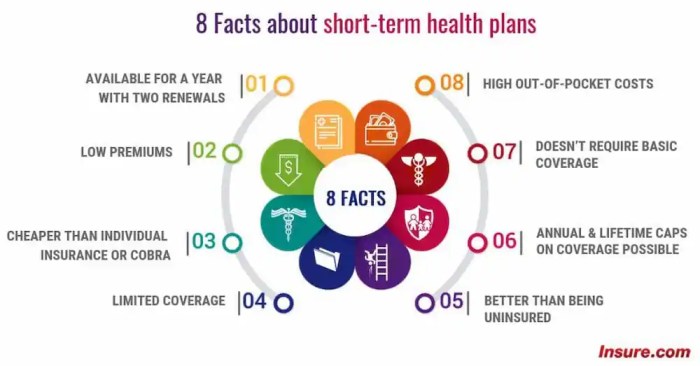

- Affordability:Short-term health insurance plans are generally more affordable than traditional health insurance plans, especially for individuals who need coverage for a short period. This affordability stems from the limited duration of coverage and the absence of certain benefits commonly found in traditional plans.

- Flexibility:Short-term health insurance offers flexibility in terms of coverage periods. Individuals can choose a plan that aligns with their specific needs and timeframe, ranging from a few months to a year. This flexibility allows individuals to tailor their coverage to their unique circumstances.

Short-term health insurance can be a lifesaver for those in between jobs or facing unexpected medical expenses. It’s a bit like having a temporary safety net, much like Commercial property insurance provides a cushion against unforeseen events for your business.

Just remember, short-term plans often have limitations, so it’s essential to read the fine print and understand exactly what’s covered.

- Simplicity:Short-term health insurance plans are often simpler than traditional health insurance plans, with fewer restrictions and exclusions. This simplicity makes it easier for individuals to understand their coverage and benefits, leading to a more straightforward insurance experience.

Comparison to Traditional Health Insurance Plans

Short-term health insurance differs significantly from traditional health insurance plans in several key areas:

- Coverage Duration:Traditional health insurance plans provide continuous coverage, while short-term plans offer coverage for a limited period, typically ranging from 30 to 364 days. This difference in duration is a defining characteristic of short-term health insurance.

- Benefits:Traditional health insurance plans typically offer a broader range of benefits, including preventive care, maternity care, and mental health services. Short-term plans may have limited coverage for these benefits or exclude them altogether.

- Pre-existing Conditions:Traditional health insurance plans are required to cover pre-existing conditions, while short-term plans may not. This means individuals with pre-existing conditions may not be eligible for coverage or may face higher premiums.

- Renewal:Traditional health insurance plans are typically renewable, while short-term plans may not be. This means individuals may need to reapply for coverage at the end of their term, and there is no guarantee that they will be approved.

Eligibility and Coverage

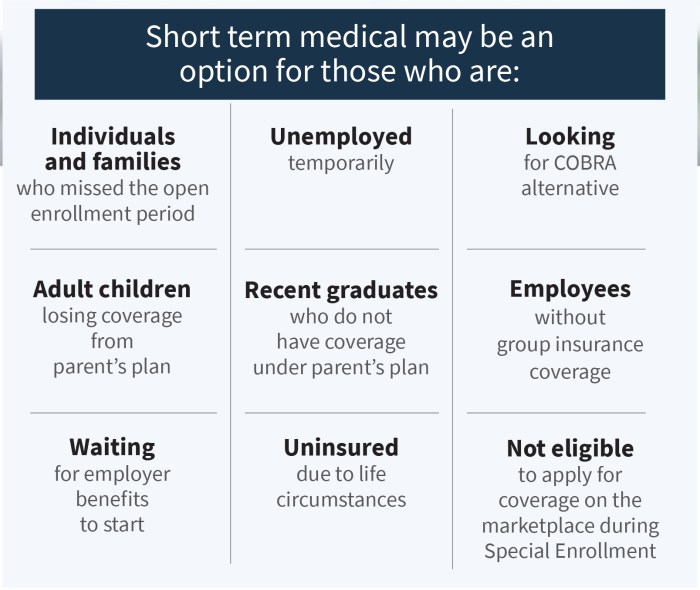

Short-term health insurance is a temporary option that can bridge the gap between health insurance plans or provide coverage for a specific period. It’s crucial to understand the eligibility criteria and coverage details before choosing this type of plan.

Eligibility Criteria

Short-term health insurance plans have less stringent eligibility requirements compared to traditional health insurance. However, they are not universally available and have specific criteria that must be met.

- Age:Most plans have a minimum age requirement, typically 18 years old. However, some plans may have a maximum age limit, which varies depending on the insurer.

- Residency:Short-term health insurance is generally available to individuals residing in the state where the plan is offered. You may need to provide proof of residency.

- Pre-existing Conditions:Short-term health insurance plans are not required to cover pre-existing conditions. This means if you have a health condition that existed before you applied for the plan, it might not be covered. However, some plans may offer limited coverage for pre-existing conditions.

- Waiting Periods:There may be waiting periods before certain benefits become effective. For instance, there might be a waiting period before you can access coverage for specific procedures or conditions.

Coverage Details

Short-term health insurance plans typically cover a limited range of essential medical services. The specific coverage varies depending on the insurer and the plan you choose.

- Hospitalization:Short-term health insurance plans generally cover hospitalization expenses, including room and board, but may have limitations on the length of stay or specific procedures covered.

- Surgery:Coverage for surgery is often included, but the scope of coverage may be limited to certain procedures. Pre-authorization may be required for some surgical procedures.

- Prescription Drugs:Coverage for prescription drugs is typically limited to a formulary, a list of approved medications. You may have to pay a co-pay or coinsurance for prescription drugs.

- Emergency Care:Emergency care is usually covered, but it’s essential to understand the plan’s limitations and out-of-pocket expenses for emergency services.

- Preventive Care:Some short-term health insurance plans may cover preventive services like vaccinations and screenings, but the coverage may be limited.

Exclusions and Limitations

It’s crucial to be aware of common exclusions and limitations in short-term health insurance plans.

- Pre-existing Conditions:As mentioned earlier, short-term health insurance plans are not required to cover pre-existing conditions. This means if you have a health condition that existed before you applied for the plan, it might not be covered. This is a significant limitation of short-term health insurance.

- Mental Health and Substance Abuse:Coverage for mental health and substance abuse services is often limited or excluded entirely. It’s essential to check the plan’s coverage details before enrolling.

- Pregnancy and Maternity Care:Short-term health insurance plans typically do not cover pregnancy and maternity care. This is a crucial consideration if you are pregnant or planning to become pregnant.

- Long-Term Care:Long-term care services, such as nursing home care or assisted living, are generally not covered by short-term health insurance plans.

- Out-of-Pocket Expenses:Short-term health insurance plans often have high deductibles, co-pays, and coinsurance. These out-of-pocket expenses can quickly add up, making it essential to carefully consider the plan’s financial implications.

Cost and Affordability

Short-term health insurance can be an attractive option for individuals who need temporary coverage or who are looking for a more affordable alternative to traditional health insurance. However, it is crucial to understand the cost factors and how they compare to other health insurance options before making a decision.

Factors Affecting Cost

The cost of short-term health insurance is determined by several factors. These factors are important to consider when comparing different plans and determining the affordability of short-term health insurance for your specific needs.

- Age: Generally, older individuals tend to have higher health insurance premiums, as they are statistically more likely to require medical care.

- Location: The cost of health care varies significantly across different geographic areas. Short-term health insurance premiums often reflect these regional differences in healthcare costs.

- Health Status: Individuals with pre-existing conditions may face higher premiums, as insurance companies assess the risk of covering potential medical expenses.

- Coverage Level: The level of coverage you choose will directly impact your premium. Plans with higher coverage limits or more comprehensive benefits will typically cost more.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums.

- Co-pays and Co-insurance: Co-pays are fixed amounts you pay for specific services, while co-insurance is a percentage of the cost you share with your insurer. Higher co-pays and co-insurance can lead to lower premiums.

Affordability Comparison, Short-term health insurance

Short-term health insurance is often touted for its affordability, but it’s essential to compare it with other health insurance options to assess its true value.

- Traditional Health Insurance: Traditional health insurance plans offer comprehensive coverage, including preventive care, hospitalization, and prescription drugs. However, they typically have higher monthly premiums than short-term plans.

- Medicaid: Medicaid is a government-funded health insurance program for low-income individuals and families. It provides comprehensive coverage at a significantly lower cost or even free of charge, making it an extremely affordable option for those who qualify.

- Medicare: Medicare is a federal health insurance program for individuals aged 65 and older or those with certain disabilities. It offers various coverage options, but premiums and out-of-pocket costs can vary depending on the chosen plan.

Pros and Cons of Short-Term Health Insurance

Short-term health insurance can be a valuable option for individuals and families seeking temporary coverage, but it’s crucial to understand its advantages and disadvantages before making a decision. This type of insurance offers flexibility and affordability, but it may not be suitable for everyone, especially those with pre-existing conditions or long-term health needs.

Advantages and Disadvantages of Short-Term Health Insurance

| Advantages | Disadvantages |

|---|---|

| Lower Premiums | Limited Coverage |

| Flexibility and Short-Term Coverage | Pre-Existing Conditions May Not Be Covered |

| No Medical Underwriting | Limited Benefits |

| May Be a Suitable Option for Healthy Individuals | Potential for High Out-of-Pocket Costs |

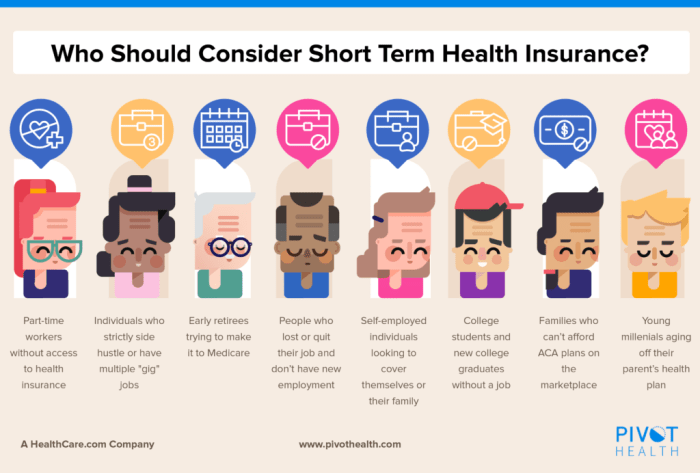

Situations Where Short-Term Health Insurance May Be Suitable

Short-term health insurance can be a viable option in specific situations. For example, individuals who are:

- Between jobs and need temporary coverage until they enroll in a new employer-sponsored plan.

- Self-employed or work as independent contractors and are looking for affordable coverage.

- Waiting for eligibility for Medicare or Medicaid.

- Traveling abroad and need temporary health insurance.

Potential Risks and Drawbacks

While short-term health insurance can be a cost-effective solution in some cases, it’s important to be aware of the potential risks and drawbacks. These include:

- Limited Coverage:Short-term health insurance plans often have limited coverage compared to traditional health insurance plans. They may not cover pre-existing conditions, essential health benefits, or preventive care.

- High Out-of-Pocket Costs:Short-term plans may have high deductibles, copayments, and coinsurance, leading to significant out-of-pocket expenses for medical services.

- Limited Renewal Periods:Short-term health insurance plans typically have limited renewal periods, ranging from 30 to 364 days. Once the plan expires, you may need to reapply for coverage, which could be denied if your health status changes.

- Pre-Existing Conditions:Short-term plans may not cover pre-existing conditions, meaning you may be responsible for the full cost of treatment if you develop a health issue that was present before you purchased the policy.

- Limited Access to Networks:Short-term plans may have limited networks of providers, making it challenging to find a doctor or hospital within your plan.

Alternatives to Short-Term Health Insurance

If you’re looking for health insurance options beyond short-term plans, there are several alternatives that offer varying levels of coverage and affordability. Let’s explore some of these alternatives and see how they stack up against short-term plans.

Individual Health Insurance Plans

Individual health insurance plans are comprehensive health insurance policies purchased directly by individuals, not through an employer. These plans offer a wider range of coverage options compared to short-term plans, including preventive care, hospitalization, and prescription drugs. They also tend to have longer coverage periods, typically lasting for a year or more.

Here are some key benefits and drawbacks of individual health insurance plans:

Benefits

- Comprehensive coverage: Individual plans typically cover a wider range of medical services, including preventive care, hospitalization, and prescription drugs.

- Longer coverage periods: Unlike short-term plans, individual plans typically offer coverage for a year or more, providing continuous protection.

- Access to a broader network: Individual plans often have larger provider networks, giving you more options for healthcare providers.

- Potential for tax benefits: Premiums for individual plans may be tax-deductible, depending on your tax situation.

Drawbacks

- Higher premiums: Individual plans generally have higher premiums compared to short-term plans due to their broader coverage.

- Pre-existing condition limitations: Some plans may have restrictions on coverage for pre-existing conditions, especially if you have a history of health issues.

- Open enrollment periods: You can typically only enroll in individual plans during specific open enrollment periods, unless you qualify for a special enrollment period due to a life event.

Health Sharing Ministries

Health sharing ministries are faith-based organizations that pool members’ contributions to help pay for medical expenses. These ministries operate on the principle of sharing the burden of healthcare costs among members. They typically have lower monthly costs compared to traditional health insurance plans, but they may not offer the same level of coverage.

Benefits

- Lower monthly costs: Health sharing ministries often have lower monthly costs compared to individual health insurance plans.

- Community support: Members of a health sharing ministry often benefit from a sense of community and support.

- Emphasis on healthy living: Many ministries encourage healthy lifestyles and promote preventive care.

Drawbacks

- Limited coverage: Health sharing ministries may not cover all medical expenses, and they may have restrictions on coverage for certain conditions or procedures.

- Faith-based requirements: Membership in a health sharing ministry typically requires adherence to certain religious beliefs or principles.

- No legal protection: Health sharing ministries are not regulated as insurance companies, so they may not offer the same legal protections as traditional insurance plans.

Resources and Information

It’s essential to have accurate and reliable information when making decisions about your health insurance. Fortunately, there are several resources available to help you understand short-term health insurance and make informed choices.

Official Websites

These official websites provide comprehensive information about short-term health insurance and other health insurance options:

- The Centers for Medicare & Medicaid Services (CMS):The CMS website offers detailed information about short-term health insurance, including eligibility requirements, coverage limits, and consumer protection resources. https://www.cms.gov/

- The National Association of Insurance Commissioners (NAIC):The NAIC website provides a directory of state insurance departments where you can find information about short-term health insurance in your specific state. https://www.naic.org/

- Your State Insurance Department:Each state has an insurance department that regulates health insurance plans, including short-term health insurance. You can find your state’s insurance department website on the NAIC website.

Key Information about Short-Term Health Insurance

The following table summarizes key information about short-term health insurance, including average costs, coverage limits, and eligibility requirements.

| Key Information | Average Costs | Coverage Limits | Eligibility Requirements |

|---|---|---|---|

| Monthly Premium | $100-$500 (varies by state, plan, and coverage) | Limited to a specific period, usually 3-12 months. | Must be a U.S. citizen or legal resident.Must not have pre-existing conditions.May be required to provide proof of insurability. |

| Coverage | Limited to essential health benefits (varies by state). | May exclude coverage for pre-existing conditions. | Must be in good health. |

| Benefits | Limited compared to traditional health insurance plans. | May not cover all necessary medical expenses. | May not be eligible if you’re currently enrolled in a health insurance plan. |

Epilogue

Short-term health insurance can be a valuable tool for those seeking temporary coverage, but it’s important to understand its limitations and weigh its pros and cons carefully. By exploring your options and understanding the fine print, you can make an informed decision about whether short-term health insurance is the right choice for you.

FAQ Compilation

Is short-term health insurance right for everyone?

Short-term health insurance is not a one-size-fits-all solution. It’s best for those who need temporary coverage and have a good understanding of its limitations.

What are some common exclusions in short-term health insurance plans?

Common exclusions can include pre-existing conditions, maternity care, and mental health services. It’s important to carefully review the policy details to understand what is and isn’t covered.

How can I find a reputable short-term health insurance provider?

Start by checking with your state insurance department and researching online for reputable providers. It’s always a good idea to compare quotes and coverage details from multiple providers.