What are full coverage car insurance quotes? Imagine your car as your trusty steed, ready to take you on any adventure. But what happens if your steed gets a little banged up or worse, disappears? That’s where full coverage car insurance comes in, acting as your trusty shield against unexpected mishaps.

This type of insurance provides a safety net, protecting you financially from the perils of the road.

Full coverage car insurance is a combination of different types of coverage, designed to protect you in various scenarios. Think of it like a superhero team, each member with a unique power, working together to keep you safe. This team includes comprehensive coverage, which safeguards you against damages from events like theft or natural disasters, and collision coverage, which steps in when you bump into another car or object.

With full coverage, you can rest assured that you’re covered in case of an accident, vandalism, or even a hailstorm!

Full Coverage Car Insurance

Full coverage car insurance is a comprehensive type of insurance policy that offers protection against a wide range of risks, including damage to your vehicle and liability for accidents. It typically combines two primary types of coverage: collision and comprehensive.

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage protects you from damage caused by non-collision events like theft, vandalism, fire, or natural disasters.

Benefits of Full Coverage Car Insurance

Full coverage insurance provides significant financial protection and peace of mind. It can help you avoid substantial out-of-pocket expenses in the event of an accident or damage to your vehicle. This coverage is particularly valuable for newer or more expensive vehicles, as it ensures that you can get your car repaired or replaced without significant financial strain.

When Full Coverage is Crucial

- Financing a Vehicle:If you have a car loan or lease, your lender will typically require you to have full coverage insurance. This ensures that they are protected in case of damage or loss of the vehicle.

- Driving a Newer or Expensive Vehicle:Newer vehicles depreciate rapidly, making them more expensive to replace. Full coverage ensures that you can get your car repaired or replaced without significant financial hardship.

- Living in a High-Risk Area:If you live in an area with a high rate of car theft or accidents, full coverage provides essential protection against these risks.

Key Components of Full Coverage

Full coverage car insurance, while a common term, isn’t a single policy. It’s a combination of various coverages that provide comprehensive protection for your vehicle and financial security in case of accidents or unforeseen events. Understanding the key components of full coverage is crucial to making informed decisions about your insurance needs and ensuring you have the right protection.

Components of Full Coverage, What are full coverage car insurance quotes?

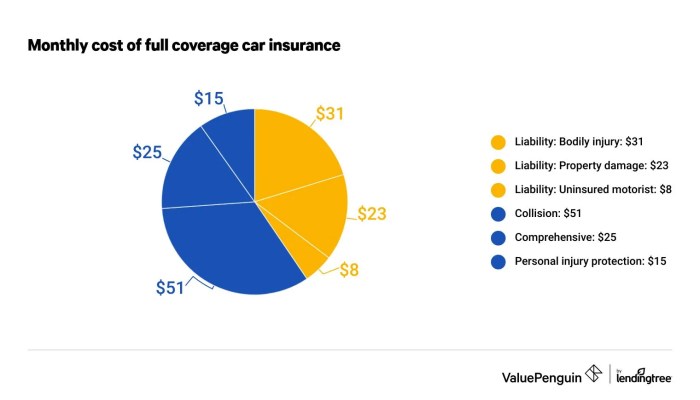

Full coverage car insurance typically includes the following essential components:

| Component | Description | Coverage | Example |

|---|---|---|---|

| Liability Coverage | Covers damages to other people’s property and injuries to others in an accident where you are at fault. | Bodily injury liability and property damage liability. | You rear-end another car, causing damage to their vehicle and injuries to the driver. Your liability coverage would pay for the repairs to the other car and medical expenses for the injured driver. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Pays for repairs or replacement of your vehicle after a collision with another vehicle or object. | You collide with a parked car, causing significant damage to your vehicle. Your collision coverage would pay for the repairs or replacement of your car. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. | Pays for repairs or replacement of your vehicle after damage caused by events not related to a collision. | Your car is stolen and never recovered. Your comprehensive coverage would pay for the replacement value of your vehicle. |

| Uninsured/Underinsured Motorist Coverage | Protects you in case you are involved in an accident with a driver who is uninsured or underinsured. | Covers your medical expenses and property damage if the other driver is uninsured or does not have enough coverage to cover your losses. | You are hit by a driver who has no insurance, resulting in injuries and damage to your vehicle. Your uninsured/underinsured motorist coverage would help pay for your medical expenses and vehicle repairs. |

Factors Influencing Full Coverage Quotes

Understanding the factors that influence full coverage car insurance quotes is crucial for making informed decisions about your coverage and potentially saving money on your premiums. Several factors play a significant role in determining the cost of your full coverage insurance.

Factors Impacting Full Coverage Quotes

Car insurance companies use a complex algorithm to calculate your premium, taking into account various factors that contribute to your risk profile. These factors are categorized into several groups, each impacting the final quote in different ways.

| Factor | Impact on Quote |

|---|---|

| Driving History | A clean driving record with no accidents or traffic violations will generally lead to lower premiums. Conversely, a history of accidents or traffic violations will increase your risk profile, resulting in higher premiums. |

| Age and Gender | Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums. Similarly, gender can also play a role, as statistics show certain genders may have a higher accident frequency. |

| Location | The area where you live can influence your insurance premiums. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents may have higher insurance rates. |

| Vehicle Type | The make, model, and year of your car can significantly affect your insurance premiums. Luxury cars, high-performance vehicles, and vehicles with a history of theft or accidents are often associated with higher risk and therefore higher premiums. |

| Credit Score | In some states, insurance companies consider your credit score when determining your premiums. A good credit score may lead to lower premiums, while a poor credit score could result in higher premiums. |

| Coverage Options | The specific coverage options you choose, such as comprehensive and collision coverage, will directly impact your premiums. Choosing a higher deductible can lower your premiums, while opting for more comprehensive coverage will increase your premiums. |

Tips for Lowering Full Coverage Premiums

While some factors influencing your premiums are beyond your control, there are several steps you can take to lower your full coverage car insurance premiums.

- Maintain a Clean Driving Record: By driving safely and avoiding accidents and traffic violations, you can significantly reduce your risk profile and potentially lower your premiums.

- Consider a Higher Deductible: Opting for a higher deductible means you will pay more out of pocket in case of an accident, but it can lead to lower premiums.

- Shop Around for Quotes: Get quotes from multiple insurance companies to compare rates and find the best deal.

- Bundle Your Policies: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in discounts.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

- Ask About Discounts: Many insurance companies offer discounts for good students, safe drivers, or those who install anti-theft devices in their vehicles.

Obtaining Quotes and Comparison

The process of obtaining full coverage car insurance quotes is straightforward and often involves gathering your personal and vehicle information and providing it to various insurance companies. However, simply getting quotes isn’t enough; comparing them is crucial to finding the best deal.

Full coverage car insurance quotes are like a safety net for your shiny new ride. They cover everything from collisions and theft to natural disasters and medical expenses. But for new drivers, finding the best deals can be a real head-scratcher.

That’s where a little research comes in handy. Check out this article on what are the best car insurance quotes for new drivers? to learn some insider tips and tricks for getting the most affordable coverage. Once you’ve got a handle on the basics, you can confidently compare full coverage car insurance quotes and find the perfect policy for your needs.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is essential because prices can vary significantly, and each insurer may offer different coverage options and discounts. This comparison helps you identify the most competitive rates and find a policy that aligns with your specific needs and budget.

Steps for Conducting a Thorough Quote Comparison

- Gather Your Information:Before starting, compile all the necessary information, including your driver’s license details, vehicle information (make, model, year, VIN), driving history, and any relevant discounts you might qualify for. This will streamline the quote process.

- Use Online Quote Tools:Many insurance companies have online quote tools that allow you to quickly get an estimate. These tools often ask for basic information and provide a preliminary quote. This step is a great starting point for your comparison.

- Contact Insurers Directly:After using online tools, reach out to several insurers directly to discuss your specific needs and get more personalized quotes. This allows you to ask questions about coverage options and discounts and clarify any details.

- Compare Coverage Details:Don’t just focus on the price; carefully compare the coverage details offered by each insurer. Ensure the coverage limits and deductibles meet your requirements and that the policy includes essential features like collision, comprehensive, and liability coverage.

- Consider Discounts:Many insurers offer discounts for various factors, such as safe driving records, good credit scores, bundling policies, and having safety features in your vehicle. Inquire about these discounts and factor them into your comparison.

- Review Policy Documents:Once you’ve narrowed down your choices, thoroughly review the policy documents provided by each insurer. Pay attention to the fine print, exclusions, and any limitations on coverage.

Choosing the Right Policy

You’ve gathered a handful of full coverage car insurance quotes, and now it’s time to make a decision. Don’t rush into choosing the cheapest option without carefully considering the coverage details. Each quote represents a different policy, and understanding the nuances is crucial to getting the right protection for your needs and budget.

Factors to Consider When Selecting a Policy

It’s not just about the price tag. A comprehensive evaluation of your needs and the features of each policy will help you make a smart decision.

- Coverage Limits: Each policy specifies the maximum amount the insurer will pay for specific types of claims. Compare these limits to ensure they align with your risk tolerance and potential financial exposure. For example, if you own a high-value car, you might need higher limits for collision and comprehensive coverage.

- Deductibles: This is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles generally lead to lower premiums, but you’ll need to be prepared to shoulder more of the financial burden in case of an accident.

- Exclusions and Limitations: Every policy has its own set of exclusions and limitations. Read the fine print carefully to understand what situations are not covered. For example, some policies might exclude coverage for certain types of accidents or have limitations on rental car reimbursement.

- Discounts: Insurance companies offer various discounts, such as good driver discounts, multi-car discounts, or safe driving discounts. Explore these discounts to see if you qualify for any savings.

- Customer Service and Claims Process: Research the insurer’s reputation for customer service and claims handling. Look for companies known for prompt and fair claims processing. You can check online reviews or contact the insurance department in your state for consumer complaints.

- Financial Stability of the Insurer: Ensure the insurance company is financially sound and has a strong track record of paying claims. You can check the insurer’s ratings from agencies like A.M. Best or Standard & Poor’s.

Summary: What Are Full Coverage Car Insurance Quotes?

So, there you have it! Understanding full coverage car insurance quotes is like unlocking a secret treasure chest of financial security. By understanding the factors that influence your quote and carefully comparing options, you can find the perfect policy to fit your needs and budget.

Remember, a little knowledge goes a long way in navigating the world of car insurance, so don’t be afraid to ask questions and explore your options. Drive safely and enjoy the journey!

FAQ Summary

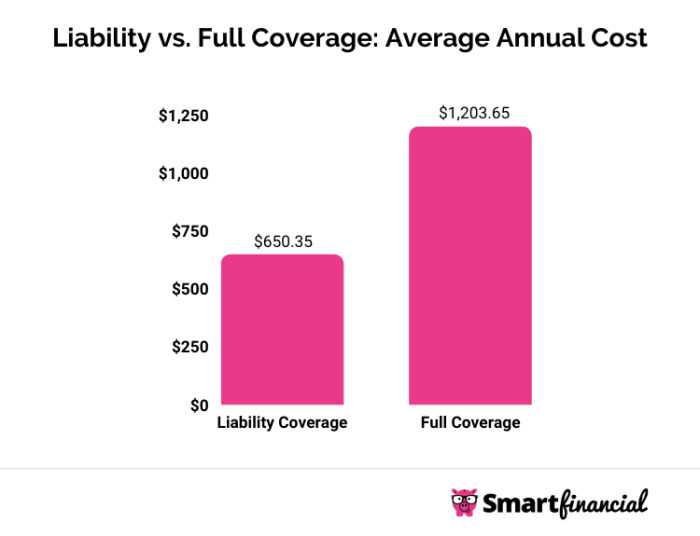

What is the difference between full coverage and liability insurance?

Liability insurance covers damages you cause to others, while full coverage covers your own vehicle in addition to liability. Think of it like having an umbrella for your car that protects it from various risks.

Is full coverage always necessary?

Not necessarily! If your car is older or has a lower value, the cost of full coverage might not be worth it. It’s best to weigh your car’s value, your financial situation, and your driving habits to determine if full coverage is the right choice for you.

How can I lower my car insurance premiums?

There are several ways to potentially reduce your premiums, including maintaining a good driving record, taking defensive driving courses, bundling your insurance policies, and choosing a higher deductible.

What happens if I cancel my full coverage insurance?

If you cancel your full coverage, you’ll only have liability coverage. This means you’ll be responsible for paying for any repairs to your own car if you’re in an accident. So, it’s important to carefully consider your options and choose the coverage that best suits your situation.